nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

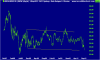

Sold the $25.25 parcel today at $25.72. Didn't like the re-testing this week of the $25.07 bottom after tapping mid $25.60's and when todays xao started to pull back I figured it was a good idea to take some profit in case we had another sell off. Looks like there are still a lot of investors willing to sell into any sort of bounce.

Also the media and the market may have to allow the Hardware start-up some settling in time. If tonight is a downer internationaly we are likely to have a down day tomorrow. The usual Friday sell off after 2:00pm could provide a re-entry. Will re-enter if there is any sort of decent retrace to $25.30 or lower. (Still hold 2 parcels).

Got sick of waiting and took a parcel at $25.27. Imediately after I bought, the share price broke through the $25.26 support and dropped down to $25.18. Thankfully there was enought support in the auction to lift the closing price to $25.25.

No doubt the u.s.a will be down on their employment figures tonight (the djia futures was down earlier) however I am looking for the weekend papers to be full of articles about the relentless growth of Woolworths and Market dominance, defensive stock in tough times etc etc and fire up the dividend strippers to push the price back up before it goes ex-div.