- Joined

- 29 January 2006

- Posts

- 7,227

- Reactions

- 4,471

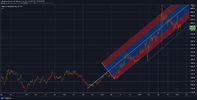

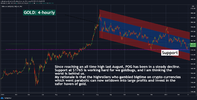

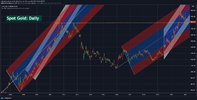

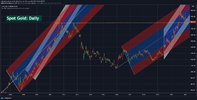

Last 14 years of gold is charted below:

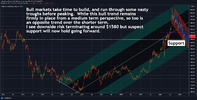

As is clearly seen, the initial bull market not only had a steeper trajectory for both its longer term and then post-GFC runs north than the present bull market, but also traded within narrower boundaries. It suggests to me a longer and more sustainable trend, and it starts from a significantly higher base.

Ever the optimist!

As is clearly seen, the initial bull market not only had a steeper trajectory for both its longer term and then post-GFC runs north than the present bull market, but also traded within narrower boundaries. It suggests to me a longer and more sustainable trend, and it starts from a significantly higher base.

Ever the optimist!