- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

Note to Self...

DO NOT POST ON GOLD THREADS

DO NOT POST ON GOLD THREADS

Patience is gold's virtue @Trav.Note to Self...

DO NOT POST ON GOLD THREADS

Don't worry @Trav., no one has any real idea where it will go. What I like to use is simple market structure. You can use it on any time frame so I'll just quickly type up what I can see. This is just one of many potential scenarios.I am only new to watching the XAUUSD and I have probably got the TA wrong 100% of the time so far.

There is so much written about gold on social media that it can easily influence you in the way that you view a chart.

I am hoping for a turn around but currently only hold 1 gold stock which is more luck than good planning.

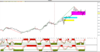

Weekly chart below for reference but as stated above I am not sure what it will do from here.

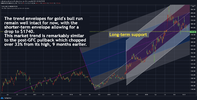

POG ran strong for 2 years after the GFC.Gee only $3,000, rats

Oddly enough I have done much better out of the decline then I did from the advance in July/August but hopefully we get another crack at higher prices later in the year.Hard to remain bullish!

View attachment 119547

Being in for the long haul, I have become used to these pullbacks, so won't be jumping ship for a good while.

What I have found interesting is that the shine did not rub off that badly on the big gold producers, so on resumption on my presumptive gold bull market, these stock should lift nicely.

Big call mate, hopefully just a little dip to to ~$1750 but will be interesting to watch on the sidelines.dropping to $1600

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.