- Joined

- 4 February 2006

- Posts

- 564

- Reactions

- 0

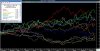

I've long held the view that the US in particular entered a secular bear market nearly 9 years ago and that we won't see sustained upward moves there until it's over. Historically, they've taken 15 - 20 years and I can see no reason for this one to be any quicker.

So the second half of next decade would be my guess for the broad market. Of course some stocks will do very well long before then and the task is to identify which ones and invest accordingly.

For the traders, some of the strongest bull moves happen in bear markets (as we've seen recently) so lots of opportunities both short and medium term for traders.

I'll become a bull when the p/e for the broad market (ie the index) is around 7 - 8 and most people have lost interest in shares. That's the P/E calculated on trailing earnings by the way, not some fancy model or forecast earnings. Until then I'll stick to sectors likely to do well and ignore the rest.

this is some of the best actionable advice you will get - and it will be investable/tradeable.

many "became familiar" with the markets during the recent bull run when a drover's dog could make good money in the market - everything was UP (well almost)

you need to retreat to sectors (this is an excellent forum except for sector speak - its one of the things this forum does not do well)

and trading/investing through sector analysis means as Smurf indicates - concentrate on which sectors are running and then seek out the performing shares that are pulling the sector with them