One of the trading records has 360 closed trades and the other has 88 closed trades - not enough trades to be deemed statistically significant (are there any records with +1000 closed trades?).

These are good examples of short term excursions into the "black zone".

The records depict high trade frequencies (+1000 closed trades should be achievable in a couple of months, unless the operator bails on the system - as usual) - please provide links to the records and we can monitor the outcome at +1000 closed trades (if achieved).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Joined

- 6 January 2016

- Posts

- 254

- Reactions

- 187

Everything is public on myfxbook. Nothing's gonna convince ya, next will be "it's scalping - I'm gonna need to see 30+ years at least to see it holds up". Stay in your bubble, I'm done on this stupid topic of no 50%+&1:1+ in existence.

Probably is scalping

Thanks.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Guys, there is a lot of misguided information in this thread.

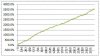

Let me simplify this matter with the following basic positive expectancy chart:

View attachment 65862:

For me green is easier to maintain than blue - particularly for a retail trader.

- The red zone is the zone of operation for most retail traders (i.e. negative expectancy);

- The large green zone is the zone of operation for trend following (or other similar strategies - less than 50% win rate with positive expectancy);

- The small blue zone is the zone of operation for mean reversion (or other similar strategies - more than 50% win rate with positive expectancy);

- The black zone is the zone of unrealistic expectations - "crystal-ball trading" (no long term records exist of a singular mechanical strategy falling in the "black zone").

I think this is generally true.

Correct, there is no mechanical system (or purely systematic trader) with a statistical significant record, that falls in the black zone.

But I am unsure how you can make such a definitive statement? Did you conduct the research yourself? Or did you find a piece of verified 3rd party research to reach this conclusion? There are so many systems out there and I'd be surprised if the researcher (be it yourself or someone else) had access to all of it. So it's simply unknowable if any system operates in the black zone...

You may believe that to be the case, with good reason, but it's simply not verifiable.

That graph tends to suggest that as you move to the top right corner your system is more profitable. Nothing could be further from the truth, the RAR will certainly increase as will the sharpe, however the CAR can drop off significantly. It's quite easy to make a system in the black zone, i have lots of them. The problem is that as i extend into this zone my drawdowns increase and exposure tends to drop off significantly. The low exposure kills the profitablility, you can get good RAR values >500%pa but that's not profit. Also the high MDD's turn me right off, having a 50% MDD and 10% exposure is unacceptable to me, yet these systems are well into this theoretical black zone with massive RAR's but are less profitable than being riskier and moving back into the green zone.

Now if i were borrowing big sums of money, i would want a bigger sharpe ratio, so adjust and head into the top right black zone again, increase RAR which will probably reduce car and try to keep MDD stable. Less profit, but a lot less risk too allowing me to increase my borrowing percentage.

In a nutshell, i have really never cared about payoff ratio ( ave no wins / ave no losses) or profit factor ( win profit / loser losses) because they mean nothing to the profitablility of a system and increasing them has an undetermined effect on system profitablility, it could go up or down depending on the effect it has on exposure. car/mdd is the single biggest thing that i look at because that determines system risk. The less risk the easier you can trade it without losing sleep. Start with a good car/mdd and everything else falls into place.

Now if i were borrowing big sums of money, i would want a bigger sharpe ratio, so adjust and head into the top right black zone again, increase RAR which will probably reduce car and try to keep MDD stable. Less profit, but a lot less risk too allowing me to increase my borrowing percentage.

In a nutshell, i have really never cared about payoff ratio ( ave no wins / ave no losses) or profit factor ( win profit / loser losses) because they mean nothing to the profitablility of a system and increasing them has an undetermined effect on system profitablility, it could go up or down depending on the effect it has on exposure. car/mdd is the single biggest thing that i look at because that determines system risk. The less risk the easier you can trade it without losing sleep. Start with a good car/mdd and everything else falls into place.

- Joined

- 13 June 2007

- Posts

- 838

- Reactions

- 136

Greetings --

My mantra is:

Trade frequently

Trade accurately

Hold a short period of time

Avoid large losses

Traders stop trading because the drawdown exceeds their tolerance. Drawdown occurs when there are either large losing trades or a sequence of small losing trades. Given a set of trades and an opportunity to add more winners or remove losers, the best (safest and most profitable) choice is to remove losers.

High accuracy:

Improves risk by lowering drawdown.

Increases profit potential by being able to trade at higher leverage for a given level of risk.

Gives better insight into the health of the system.

I strongly recommend working through the risk analysis of every trading system. Begin with the set of trades that you think is most representative of the future. Use that as the population from which a Monte Carlo study creates many equally likely trade sequences, compute the drawdown of each sequence, and evaluate the distribution of those drawdowns. If the probability of a drawdown that exceeds your tolerance is too high, the system can only be traded with a fraction of the account -- the remainder must stay in risk free issues to act as ballast for the drawdown in the exposed portion.

All of that said, the sweet spot for most traders is accuracy of at least 65%, holding period of a few days. There are many examples of systems with these characteristics. Lower accuracy or longer holding periods increase the drawdown and reduce future profitability.

Here is a link to a presentation I made related to risk:

https://www.youtube.com/watch?v=Vw7mseQ_Tmc

And here is a link to several more presentations related to trading system development -- design, testing, validation, analysis, and management. All free:

http://www.blueowlpress.com/video-presentations

The Blue Owl Press website is hosting conversations about systems development. Thoughtful questions and civil discussions are welcome.

http://www.blueowlpress.com/posts

Best regards,

Howard

My mantra is:

Trade frequently

Trade accurately

Hold a short period of time

Avoid large losses

Traders stop trading because the drawdown exceeds their tolerance. Drawdown occurs when there are either large losing trades or a sequence of small losing trades. Given a set of trades and an opportunity to add more winners or remove losers, the best (safest and most profitable) choice is to remove losers.

High accuracy:

Improves risk by lowering drawdown.

Increases profit potential by being able to trade at higher leverage for a given level of risk.

Gives better insight into the health of the system.

I strongly recommend working through the risk analysis of every trading system. Begin with the set of trades that you think is most representative of the future. Use that as the population from which a Monte Carlo study creates many equally likely trade sequences, compute the drawdown of each sequence, and evaluate the distribution of those drawdowns. If the probability of a drawdown that exceeds your tolerance is too high, the system can only be traded with a fraction of the account -- the remainder must stay in risk free issues to act as ballast for the drawdown in the exposed portion.

All of that said, the sweet spot for most traders is accuracy of at least 65%, holding period of a few days. There are many examples of systems with these characteristics. Lower accuracy or longer holding periods increase the drawdown and reduce future profitability.

Here is a link to a presentation I made related to risk:

https://www.youtube.com/watch?v=Vw7mseQ_Tmc

And here is a link to several more presentations related to trading system development -- design, testing, validation, analysis, and management. All free:

http://www.blueowlpress.com/video-presentations

The Blue Owl Press website is hosting conversations about systems development. Thoughtful questions and civil discussions are welcome.

http://www.blueowlpress.com/posts

Best regards,

Howard

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Correct, there is no mechanical system (or purely systematic trader) with a statistical significant record, that falls in the black zone. I'm sure there are short term "excursions" into the black zone, in particular for discretionary traders (i.e. lucky gut feelings), but over the longer term you require significant predictive capabilities to remain in this zone.

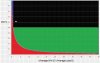

I have kept track of a system that falls in the black zone. The numbers below are from Aug 2012 to last week. Rules are purely mechanical and the numbers below are records of all signals. Win/loss are in percentage terms before transaction costs and slippage. The system is based on ASX equities and it is not infinitely scalable without introducing some slippage.

Signals 2702

Average 1.32%

Wins% 61.3%

Avg win 3.95%

Avg loss -1.79%

Avg win / avg loss = 2.2

Cumulative performance

It just scraps in the black zone, even after allowing for transaction costs.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

My mantra is:

1. Trade frequently

2. Trade accurately

3. Hold a short period of time

4. Avoid large losses

Love it.

I have been changing my style a bit of late, predominately to improve 3 and 4. I found that it doesn't just provide improved returns, but makes an overall happier, more relaxed trader!

- Joined

- 13 June 2007

- Posts

- 838

- Reactions

- 136

Hi skc --

You wrote:

I have kept track of a system that falls in the black zone. The numbers below are from Aug 2012 to last week. Rules are purely mechanical and the numbers below are records of all signals. Win/loss are in percentage terms before transaction costs and slippage. The system is based on ASX equities and it is not infinitely scalable without introducing some slippage.

Signals 2702

Average 1.32%

Wins% 61.3%

Avg win 3.95%

Avg loss -1.79%

Avg win / avg loss = 2.2

-------------------------

Those are nice results.

If you are interested, I will do some analysis of risk and profit potential for you. The data I need is a list of trades, each with the percentage change in the issue being traded, whether the position is long or short.

If these are out-of-sample results, you can probably buy Tasmania next year.

Best,

Howard

You wrote:

I have kept track of a system that falls in the black zone. The numbers below are from Aug 2012 to last week. Rules are purely mechanical and the numbers below are records of all signals. Win/loss are in percentage terms before transaction costs and slippage. The system is based on ASX equities and it is not infinitely scalable without introducing some slippage.

Signals 2702

Average 1.32%

Wins% 61.3%

Avg win 3.95%

Avg loss -1.79%

Avg win / avg loss = 2.2

-------------------------

Those are nice results.

If you are interested, I will do some analysis of risk and profit potential for you. The data I need is a list of trades, each with the percentage change in the issue being traded, whether the position is long or short.

If these are out-of-sample results, you can probably buy Tasmania next year.

Best,

Howard

- Joined

- 21 August 2008

- Posts

- 2,840

- Reactions

- 8,807

skc: I see the 'Avg loss -1.79%' on that system so naturally I gather the system risked over 1.79% on each trade. How much of the bank is risked on each trade in the system?

Thanks ... debtfree

Thanks ... debtfree

- Joined

- 13 June 2007

- Posts

- 838

- Reactions

- 136

Hi DebtFree --

Pardon me if I step in ahead of skc to make a comment.

Given a set of trades that are good estimates of trades that will occur in the future, an analysis of those trades provides metrics related to the depth of drawdown that can be expected, calculation of the position size that maximizes account growth and wealth after some period of time, and annual rate of return.

The analysis uses the entire distribution. Single metrics, such as mean, standard deviation, or maximum loss are not adequate.

Best,

Howard

Pardon me if I step in ahead of skc to make a comment.

Given a set of trades that are good estimates of trades that will occur in the future, an analysis of those trades provides metrics related to the depth of drawdown that can be expected, calculation of the position size that maximizes account growth and wealth after some period of time, and annual rate of return.

The analysis uses the entire distribution. Single metrics, such as mean, standard deviation, or maximum loss are not adequate.

Best,

Howard

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Those are nice results.

If you are interested, I will do some analysis of risk and profit potential for you. The data I need is a list of trades, each with the percentage change in the issue being traded, whether the position is long or short.

If these are out-of-sample results, you can probably buy Tasmania next year.

Best,

Howard

Hi Howard,

Thanks for your kind offer but I won't bother you with the stats. I also mentioned it is not infinitely scalable so it's unlikely that it will generate returns exceeding the sale price of Tasmania.

skc: I see the 'Avg loss -1.79%' on that system so naturally I gather the system risked over 1.79% on each trade. How much of the bank is risked on each trade in the system?

Thanks ... debtfree

The -1.79% is the average negative movement in the stock at the end of the trade amongst losing trades. The biggest loss is much bigger than that. The system does not use predetermined stop loss levels. Position size would also vary a lot, mostly depending on the available liquidity. You can get signals in the biggests stocks or the smaller illiquid names, so slippage would definitely come into play when you trade too big on those fringe names.

So actual trade results won't be the same % as the raw data... but it should still be within the black zone.

- Joined

- 21 August 2008

- Posts

- 2,840

- Reactions

- 8,807

Thanks Howard and skc for your response, appreciated as your replies answer my question and fulfills my curiosity.

Cheers ... Debtfree

Cheers ... Debtfree

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Excellent posts here, including graph in post#10.

Would be a shame for the conversation to get bogged down in "futures versus stocks". Futures (often) more leverage and able to trade long and short.

I would be really interested too to see long term (>5yr) proof of mechanical long only stock trading systems in the "black zone".

Edit: Dammit - only read the 1st page of the thread.

skc has posted an example already.....!

Would be a shame for the conversation to get bogged down in "futures versus stocks". Futures (often) more leverage and able to trade long and short.

I would be really interested too to see long term (>5yr) proof of mechanical long only stock trading systems in the "black zone".

Edit: Dammit - only read the 1st page of the thread.

skc has posted an example already.....!

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Excellent posts here, including graph in post#10.

Would be a shame for the conversation to get bogged down in "futures versus stocks". Futures (often) more leverage and able to trade long and short.

I would be really interested too to see long term (>5yr) proof of mechanical long only stock trading systems in the "black zone".

Edit: Dammit - only read the 1st page of the thread.

skc has posted an example already.....!

My system includes both long and short trades.

- Joined

- 13 June 2007

- Posts

- 838

- Reactions

- 136

Greetings --

Regarding:

Would be a shame for the conversation to get bogged down in "futures versus stocks". Futures (often) more leverage and able to trade long and short.

-------------------------

To evaluate risk, position size, and profit potential, make your calculations assuming you are trading the entire value of each futures contract.

For example, the e-mini S&P futures contract has a margin of about $5,000 per contract. But each contract represents $50 per point. At about 1900 (current price), the full value of one futures contract is 1900 * 50 == $95,000. Compute risk, position size, and profit potential assuming you are buying a stock where each share is $95,000.

With a $100,000 account, margin lets you trade as many as 20 contracts. Prudence allows at most 1 contract. Safe-f would need to be about 2.0 in order to trade 2 contracts without the drawdown exceeding your risk tolerance. If safe-f is considerably less than 1.00, then $100,000 is not enough to trade a single contract. Say safe-f is 0.70, then about $130,000 of funding is required to trade one contract.

Best regards,

Howard

Regarding:

Would be a shame for the conversation to get bogged down in "futures versus stocks". Futures (often) more leverage and able to trade long and short.

-------------------------

To evaluate risk, position size, and profit potential, make your calculations assuming you are trading the entire value of each futures contract.

For example, the e-mini S&P futures contract has a margin of about $5,000 per contract. But each contract represents $50 per point. At about 1900 (current price), the full value of one futures contract is 1900 * 50 == $95,000. Compute risk, position size, and profit potential assuming you are buying a stock where each share is $95,000.

With a $100,000 account, margin lets you trade as many as 20 contracts. Prudence allows at most 1 contract. Safe-f would need to be about 2.0 in order to trade 2 contracts without the drawdown exceeding your risk tolerance. If safe-f is considerably less than 1.00, then $100,000 is not enough to trade a single contract. Say safe-f is 0.70, then about $130,000 of funding is required to trade one contract.

Best regards,

Howard

Similar threads

- Replies

- 15

- Views

- 2K

- Replies

- 21

- Views

- 3K

- Replies

- 8

- Views

- 2K