- Joined

- 13 August 2008

- Posts

- 404

- Reactions

- 41

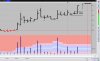

just a general discussion on what leads you up to buying a stock.

following its chart, recent announcements, or straight from the mighty movie

the castle do you pick up on the vibe ? lol

interested in your thoughts.

jc

following its chart, recent announcements, or straight from the mighty movie

the castle do you pick up on the vibe ? lol

interested in your thoughts.

jc