How does it compare to other economies through the same timeline?

You would compare it to other economies with similar exports, not the dud ones to try and make it look better then what it is.

How does it compare to other economies through the same timeline?

You would compare it to other economies with similar exports, not the dud ones to try and make it look better then what it is.

Has Swanny lied or didn't he know his numbers? Tax revenue is up 9.2% - see below:

THE Labor government is yet to show it can rein in spending, with each of its five budgets packed with high-cost initiatives and consuming a much larger share of the economy than the last five Howard government budgets.

Wayne Swan has blamed the failure to reach surplus this year on the shortfall in tax revenue, but figures for the first four months of this financial year show total receipts are 9.2 per cent ahead of last year.

http://www.theaustralian.com.au/nat...-rising-revenues/story-fn59niix-1226542121468

I congratulate you GG on your indomnitible spirit and tireless determination to open endless numbers of new threads devoid of any real substance apart from proffering yet another sensantional excuse to bash the labor party.

Damned if they do and damned if they don't, who cares lets just point the finger and launch into another thread.

Well done.

^^^ As i have been saying for over 2 years.

Indomnitible, tireless, determind, sensantional and devoid of any real substance... ironically that pretty much sums up the ASF right...and its as boring as watching paint dry.

Boring??

But your still here.

Indomitable, determined, sensational - for sure, but mainly frustrated - that we have to put up with Labor and have no power to end their incompetence for so long.

Besides which, we are having fun.

^^^ As i have been saying for over 2 years.

Indomnitible, tireless, determind, sensantional and devoid of any real substance... ironically that pretty much sums up the ASF right...and its as boring as watching paint dry.

Alternatively we could just strat printing cash to weaken our dollar. All the other cool kids are doing it with no care, so why should we be penalised for having low debt/no printing?

While i dont agree with doing it from a financial viewpoint, it is the way the game is being played these days and to try and make some sort stand which weakens the economy/jobs is like a football team deciding they will play with no interchange

Unfortunately printing is an option for the RBA but the effects against the big boys would be totally pointless.

Really the only real option the RBA has is to drop interest rates further to kill the yield which we should see next year

False - they always have been able to (subject to related party transaction restrictions - which havent changed).and recently allowing SMSF to buy residential property.

False - they always have been able to (subject to related party transaction restrictions - which havent changed).

Pre 1999 Unit Trust anyone? What about an unrelated private unit trust?But they weren't able to borrow previously. All those warrant products were designed to allow SMSF's to gain leverage without borrowing.

While trying to keep a lid on the housing bubble. LOL

Yes the RBA would like to see housing drift sideways for some time but they would like to see a up tick in construction particularly on the eastern sea board

False - they always have been able to (subject to related party transaction restrictions - which havent changed).

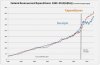

Here's a graph which shows labor have clearly been enjoying record revenues and yet they have taken us into record debt and deficits.

View attachment 50085

Read more:

http://www.michaelsmithnews.com/2012/12/these-data-show-an-awful-picture-for-the-future-of-jobs.html

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.