tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Volume is subjective unless it’s being optimized with something else.

Why optimised?

It doesn’t provide me with an edge, as I will never know when volume will appear, so why would I use something that can’t be known in advance.

You cant know anything with certainty in advance other than death and taxes.Personally I can anticipate price action through volume and price action itself.

The only thing that provides me with an edge is TIME, because it’s the only thing in the market that can be accurately predicted with precise accuracy.

In my opinion Time is the arbiter of probability and risk reward strategies, as it clearly defines the dynamics of the market and allows traders to know where they should or should not be trading in advance.

Frank marking a likley 5 day/Weekly/monthly/Quaterly or Yearly anticipated high or low and 50% level hardly guarentees accurately predicted prices.

Right now with the above analysis it is biasing toward long but with a caveat over a possible short move.

Neither will be clear until after the fact---hardly predictive!

As for THIS trade for me I'm still on the fence waiting.

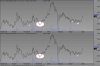

The 20 minute chart is giving me a low risk long opportunity.

Back in a minute with the chart.