- Joined

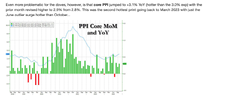

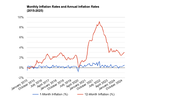

- 8 June 2008

- Posts

- 14,112

- Reactions

- 21,294

Fully agree, and yes with interest ratesWe are talking about USA inflation and what will happen.

Again I will say that it appears the Fed is going to keep interest rates up too high too long and the USA will have a very hard landing.

Trump really has nothing to do with this. And i don't really want to talk about who the next incumbent is. It is about what we should be doing in investment terms now. I didn't bring him up.

Even if Trump is the saviour, he won't be there till the end of the year.

About "I didn't bring him up." Aka Trump...

I had to scroll back and was ready to apologize..but no, it is definitively in the post I replied to .

Show you how polarising he is if he inserts himself in your own writing wo you being aware.

He is no silver bullet, and too old now but letting the existing team in control is a sure catastrophic collapse..all part of the plan..and hyperinflation in the US is part of the plan..

So do we fight the plan?

Better even, can we fight the plan and win?

And if you agree with me that we can not, how do we handle that for our selfish own self interest ?