Dona Ferentes

BHINNEKATUNGGAL IKA

- Joined

- 11 January 2016

- Posts

- 17,195

- Reactions

- 23,462

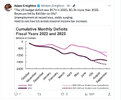

US publishes the daily cashflow of the Federal government, including outstanding debt. Total outstanding debt on the 12th May 2011 was $14,256 Billion.

twelve years on... August 22nd, 2023 , the grand total to $32.759 trillion

twelve years on... August 22nd, 2023 , the grand total to $32.759 trillion