professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

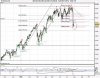

Updated chart from post #972. 6000 has now been breached. Under normal circumstances, you would expect this to be a fairly important psychological level. Expecting another gap down from the SYCOM close on Monday morning followed by a run back at the 6000 level pretty soon after the open.

I'd be very careful if anyone wanted to get short the market for a swing trade at these levels. We look very oversold right now, and if we see a short squeeze soon, it will probably be pretty vicious. A 100 point intraday rally wouldn't surprise me in the slightest on Monday, especially if we see other Asian markets being bought up after the opening gap.

I'd be very careful if anyone wanted to get short the market for a swing trade at these levels. We look very oversold right now, and if we see a short squeeze soon, it will probably be pretty vicious. A 100 point intraday rally wouldn't surprise me in the slightest on Monday, especially if we see other Asian markets being bought up after the opening gap.