For you full timers,

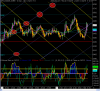

can you give some insight on any correlations (if there are any) between the spi and other index's/equities you might look at, either eod or intraday, that would actually impact your trading and how?

I.e. Are there any divergences you keep an eye on? Where certain markets closed overnight? Volume levels etc. I've seen mention of other index's from time to time but can't remember any specifics.

I'd like to focus my attention as much as possible on things that actually have an impact on the spi. I have eod futures for several markets but would buy more intraday data for certain index's if they're worth looking at.

I'm only simulation day trading and in the learning process just trying to look at as much information as I can each time to base decisions on. It's great fun while I'm not losing real money.

Cheers,

Julian.

can you give some insight on any correlations (if there are any) between the spi and other index's/equities you might look at, either eod or intraday, that would actually impact your trading and how?

I.e. Are there any divergences you keep an eye on? Where certain markets closed overnight? Volume levels etc. I've seen mention of other index's from time to time but can't remember any specifics.

I'd like to focus my attention as much as possible on things that actually have an impact on the spi. I have eod futures for several markets but would buy more intraday data for certain index's if they're worth looking at.

I'm only simulation day trading and in the learning process just trying to look at as much information as I can each time to base decisions on. It's great fun while I'm not losing real money.

Cheers,

Julian.