- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Ooops!

Call after the move perfect ( long 60 min after your call )

Call in realtime-----terrible.

It was real time within 10 seconds you arrogant tossa.

Well my re visit has been fun

Thread has denigrated to usual

Slagging.

Back to cyber space.

Enjoy your trading everyone.

It was real time within 10 seconds you arrogant tossa.

Just popped my head in and saw it's been stopped for insignificant profit. Never mind my script took 40 points from the move down. That must just eat you guys up.

Tech you might as well stay, I waste far too much time here.

Joe Blow please cancel my login and dont ever let me back.

65 point win for the night = $1,170.

Happy with the hedge position tonight.

"Oh we're in an uptrend so don't short at resistance" doesn't work.

It was crucial to watch that level tonight particularly as price stalled.

It was a 3 or 4 bar tight range setup on the 2 min that took my in my shorts.

4.5 risk per contract.

Gold to get on those with a stop at the high of the day.

Will post charts if I get time over the weekend when I do my analysis.

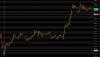

Ok as my final post here's something that I hope will help the newbies. Pav took a trade against the trend and it worked. I never said they all fail I said they were low probability. He thinks he's a super star because he made 65 points. But he traded 2 contracts so he really made 33 points per contract. But hey 65 points sounds more impressive. Here's how I went. My scripts that follow the trend made 92 points per contract and the long I took off that 50% level is still open with 82 points per contract profit with stops at 70 points. That makes at least 152 points per contract in one night trading with the trend vs 33 points trading against it. Any book that you pick up will tell you to trade with the trend. I dont know any of you and I shouldnt care, but it disturbs me when I see struggling traders listening to bad advice. It's a tough journey so good luck to all you newbies, you're gonna need it if you try and follow this bloke. <img src="https://www.aussiestockforums.com/forums/attachment.php?attachmentid=58715"/> <img src="https://www.aussiestockforums.com/forums/attachment.php?attachmentid=58716"/>

I'm at home today getting ready for a week away. Realised that CQG/AMP allows SPI trading at decent round trip commissions, and have had it up since open, watching on and off the price action.

As this is the "Transition to Futures" thread, would be interested to hear from any (Aussies?) who have moved from P/T night trading to working the SPI as well?

My initial observations from today and over the last week of price action:

- no half points - $25/point (not that different to the FTSE however) but don't see any half point movement

- less volatility and volume but still seems quite price action tradeable to patient and educated trader?

- my DOM is only show up to 5 levels either side of market, whereas Level II in other markets can be lots deeper - not a big deal to me

Was always in the back of my mind that I might tackle the SPI in the distant future. Pav, I gather from posts you've dabbled. Anyone else?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.