tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Tech/Pav:

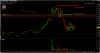

Is this another example of generally what you are looking for? This is a 15 min SPI chart.

My thoughts on the chart

View attachment 53046

Not enough volume overnight to do any meaningful analysis. SPI will be affected by the bourses overnight.

But the consolidation you show is pretty obvious if you take all 4 bars from open in context.

The open takes out long stops and closes on high volume halfway in range. That is a good signal for me to buy the top of that bar. If you look at a 3 or 5 min chart Ill bet you see a low risk entry.

The next bar is the thrust bar testing the high of the consolidation area.

The next bar takes it out on lowish volume without giving up a close below the impulse bars close.

The next two bars IMPORTANTLY test the high on lowish volume without closing below the close of the impulse bar. The Box you have drawn is another trade setup --long. Volume launches it from there.