- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

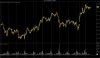

No idea on tonight.

Probably won't even look.

Only came on last night because of the gap.

Still bearish if I had to choose, however there is the gap.

Happy to sit this one out

Probably won't even look.

Only came on last night because of the gap.

Still bearish if I had to choose, however there is the gap.

Happy to sit this one out