- Joined

- 20 July 2021

- Posts

- 11,723

- Reactions

- 16,345

but but but we have FIRB to protect us from big nasty foreign opportunists ... don't we ?

Hmmmmmmmmmmmmmmmmmmmm dream on!!!!!but but but we have FIRB to protect us from big nasty foreign opportunists ... don't we ?

will be some fallout from this , even if the receivers sell it for the proverbial dollar

It's like chopping off your nose despite your face, where is most of the plastic going to go now?

It was interesting in the article, that there has been a 22% increase in company bankrupcies, mainly in manufacturing related to residential building.

Nah listen to labour, we all have tax cuts, they said it on their radio ads yesterday...The SMH giving a stark reminder of the state of the economy at street level.

Australians flattened by biggest tax increase in world

amp-smh-com-au.cdn.ampproject.org

Working Australians suffered the biggest

Increase in average tax rates in the developed world with the end of the low- and middle-income tax offset and bracket creep, just as an unusual mix of petrol, cooking oil, bread and insurance combined to drive up the cost of living.

Ten year bonds are trending up.RBA to lift cash rate to 5.1pc, says top forecaster

RBA to lift cash rate to 5.1pc, says top forecaster

Judo Bank’s Warren Hogan, who was ranked 2023’s most accurate forecaster, predicts a resurgent economy will force the RBA to lift rates to 5.1 per cent.www.afr.com

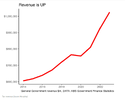

There is data trending in the right direction to semi support this view although IB futures are as dynamic and mean reverting as anything out there , atm we are seeing just a hint of a hike starting to be priced with the terminal rate now above the present cash rate for the first time in many months . The chart posted here is the projected terminal rate change in Sept as priced by IB futurtes , this chart is a little delayed with current pricing at +3 bps terminal rate in sept compared to the -50bps of cuts priced 2 months ago

View attachment 175605 View attachment 175604

Of course should have used the term 10 year "yields".

I knew what you meantOf course should have used the term 10 year "yields".

Bonds in fact are trending down.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.