- Joined

- 12 November 2007

- Posts

- 2,944

- Reactions

- 4

It remains to be seen if it is a safe investment, backed by nothing more than the

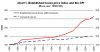

belief by the general public that 'property prices never go down", and aided by flawed government policies ie immigration, subsidies and NG? And the banks contribute the most by indebting a large swathe of the population to mortgage stress. And a little bit of supply and demand imbalance again caused by flawed gov policies? Plenty of cheap land in better lifestyle regional areas.

"hedged against inflation" - that would apply only if the return is above inflation? You don't see property investors subtracting out the loss from inflation when they do their sums on how much money they made from an investment?

I think the sweet spot for property (low rates, foreign investment, gov subsidies) has passed and is on the top taper now (blow off tops from the stragglers buying), the stress wave is working it's way up from the bottom, as it did just before the GFC.

The income stream is very safe, The tenant pays weekly and you are in control so there is no risk of a company director slashing dividends.

the rent will also increase over time atleast in pace with inflation and the capital you have invested will also increase atleast with inflation.

So if you were to compare putting $300K into a rental property Vs $300K into a term deposit, over time the rental will perform better due to the fact assets increase with inflation so your weekly income and the capital value is protected where as with the term deposit invested capital and income remain the same and steadily lose buying power.