- Joined

- 31 March 2015

- Posts

- 477

- Reactions

- 865

Easy money policies will only produce a temporary illusionary growth and will fail to improve the the fundamentals of a stagnant economy. The more they will try the more the less it will respond. The BOJ tried it for 15 years and got nowhere( and house prices in Japan continued to capitulate). The US now is the same boat, the FED and other central banks must inflate or die.The money printing hasn't even begun, and house prices aren't counted in the inflation calculations.

As long as the printed money is diverted into house prices alone, we won't see interest rate increases but we will see house price increases.

They know how to keep it going.

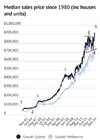

Forget about perpetually rising asset prices, they already off the planet and whilst they may continue to persist for a short while it won't last because this debt bubble is no different to any other bubble in history. They all eventually end in bust WITHOUT exception.

Markets are now at the crossroads. Most are expecting a slow transition away from the Covid Winter back to normality and the "good times".

Covid is here and will fizzle out in time, but the psychological and economic reality as result of Central Bank reckless monetery policies will not and there will be a heavy price to pay by all of us in the end.

Look at your charts you will see that as a bull market progresses and nears the terminal phase this is characterized by wide ranging bars both up and down and an increase in volatility. We are already there in the US markets (not to mention the housing market here), look at the volatility the last 12 months alone. This sets up for momentum divergence that eventually lead to final high.

Prepare for a lost decade charactirized by large swings up and down and a traders market.