- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

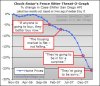

Not that this will ever happen here ! Have posted previously too many regulations and mechanisms in place to fall tragically. Also have posted that due to the softening demand of finance due to interest rate hikes will also reduce likelihood of bubble territory. Steady as she goes boys and girls.