You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The future of Australian property prices

- Thread starter Joe Blow

- Start date

- Joined

- 6 January 2009

- Posts

- 2,300

- Reactions

- 1,130

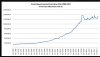

This chart tells a thousand stories.

It would seem we reach resistance at around 160% debt to disposable income.

It would also seem that the momentum increased :

After the last recession

Deregulation of the banking sector

Market flooded with cheap debt

The increase of women working full time which I believe as peak around 2010.

Most of the above has reached 100% saturation.

Putting a rocket under a rocket ship doesn't always make it fly straight.

I foresee several things happening to the property market in the short term :

- A recovery/uptick in prices due to low interest rates, people rushing to the market, herd mentality

- A period of stagnation where many who bought find the returns/yields to be insufficient and that negative gearing just isn't working as an investment strategy

- Slowing of the economy and employment rising

- Inflation starting to hurt the every day australian with rising costs and no way growth, RBA starts to look to the heavens for another solution

- A turn point in structural beliefs in Australia society that property is a easy investment, everyday business getting tougher, the fit will survive but many have become slow over the last 30 years.

- A slow but steady rush to the gate to offload property for the over indebted.

Price correct over many years. How much and how far, anyone's guess

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

Households are saddled with around $400B in excess relatively unproductive debt.

I've yet to have a property spruiker tell my why above wage growth increases in property prices is good for the economy.

- Joined

- 3 July 2009

- Posts

- 27,819

- Reactions

- 24,825

View attachment 53764

This chart tells a thousand stories.

It would seem we reach resistance at around 160% debt to disposable income.

It would also seem that the momentum increased :

After the last recession

Deregulation of the banking sector

Market flooded with cheap debt

The increase of women working full time which I believe as peak around 2010.

Most of the above has reached 100% saturation.

Putting a rocket under a rocket ship doesn't always make it fly straight.

I foresee several things happening to the property market in the short term :

- A recovery/uptick in prices due to low interest rates, people rushing to the market, herd mentality

- A period of stagnation where many who bought find the returns/yields to be insufficient and that negative gearing just isn't working as an investment strategy

- Slowing of the economy and employment rising

- Inflation starting to hurt the every day australian with rising costs and no way growth, RBA starts to look to the heavens for another solution

- A turn point in structural beliefs in Australia society that property is a easy investment, everyday business getting tougher, the fit will survive but many have become slow over the last 30 years.

- A slow but steady rush to the gate to offload property for the over indebted.

Price correct over many years. How much and how far, anyone's guess

IMO either they inflate away the problem, or your prediction comes true.

I have noticed property is selling fast again these last few weeks. I went to an open house today across the road from a property I own and was surprised that the owner had knocked back an offer of $575k and was holding out for more from another interested party (I wouldn't pay over $480k for it). I paid $375k a year and a bit ago and have probably double the land size. Some townhouses up the road sold for a lot more then what I thought they would as well. I'm just surprised people are paying those kinds of prices.

At this stage I'm thinking this might be the final push given that business in this country looks screwed on every front in general and I can't see the standard of living staying where it currently is once they start firing. In fact it looks downhill from here unless whatever govt in power starts to turn it around. But you never can tell how long these things can go on for.

Property in the lower end of town looks like it fell pretty hard though, as there are some cheap houses in the areas I was looking.

At this stage I'm thinking this might be the final push given that business in this country looks screwed on every front in general and I can't see the standard of living staying where it currently is once they start firing. In fact it looks downhill from here unless whatever govt in power starts to turn it around. But you never can tell how long these things can go on for.

Property in the lower end of town looks like it fell pretty hard though, as there are some cheap houses in the areas I was looking.

Households are saddled with around $400B in excess relatively unproductive debt.

I've yet to have a property spruiker tell my why above wage growth increases in property prices is good for the economy.

Why would they?

I don't think most people invest or buy a ppor with that in mind

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

Why would they?

I don't think most people invest or buy a ppor with that in mind

Seriously? House prices is about the only thing that unites this country.

Isn't the great NIMBY all about protecting property values (always presented as protecting the general amenity of the area)

I think anyone willingly devoting half of their after tax income to a mortgage is crazy.

I say take advantage of brain addled negatively geared investors willing to lend you their property at below cost. There's plenty of other ways to build wealth.

- Joined

- 8 June 2008

- Posts

- 13,294

- Reactions

- 19,644

I have to say I agree with the bearish medium term but bullish in the next few months position:

SMSF are rushing to buy property (with return of 2.5%??????) and every John and his dog is dreaming of repeating the story of 10y ago.

During that time, jobs are falling everywhere (do not know where the government got its employement figures, what I hear around is job lost AND unable to find another one.

I know mining, IT business analysts, PM, and consultants , engineers, may not be the people counting in numbers and they never go to Centerlink, but they are the one which could pay these mortgage and IP, not the part time telstra shop assistants..

So a quick last burst then a period of stagnation (can not go down, RE will win over the long time, etc) then bank calling, need retirement cash with TD at 1% before tax and we get the rush to the exit..

The question is when to sell when you own, and where do you put your cash to ensure it will not be seized.

wait and see

august 2013: today, euphoria till july 2014 panic by january 2015?

Let's see if i am wrong (actually wish I am as the depression Australia might need to have may not be pleasant for anyone)

SMSF are rushing to buy property (with return of 2.5%??????) and every John and his dog is dreaming of repeating the story of 10y ago.

During that time, jobs are falling everywhere (do not know where the government got its employement figures, what I hear around is job lost AND unable to find another one.

I know mining, IT business analysts, PM, and consultants , engineers, may not be the people counting in numbers and they never go to Centerlink, but they are the one which could pay these mortgage and IP, not the part time telstra shop assistants..

So a quick last burst then a period of stagnation (can not go down, RE will win over the long time, etc) then bank calling, need retirement cash with TD at 1% before tax and we get the rush to the exit..

The question is when to sell when you own, and where do you put your cash to ensure it will not be seized.

wait and see

august 2013: today, euphoria till july 2014 panic by january 2015?

Let's see if i am wrong (actually wish I am as the depression Australia might need to have may not be pleasant for anyone)

I was commenting on no one buys a house for the reason its good for the economy.I've yet to have a property spruiker tell my why above wage growth increases in property prices is good for the economy.

I'm sure there are some upsides for the economy:

It keeps construction ticking over on which supposedly 40% of the cost of new homes is taxes also flow on effects to the material suppliers.

Keeps unemployment and further drain on welfare down.

Bigger rates for council.

Should be an increase in building and lowering of prices/rents in the end.

Higher wages and spending

Not sure if it offsets all the tax perks that comes with property though and I'm not interested in a counter list for the above as I think after 527 pages we all know them.

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

from HnH at macrobusiness

looks like either interest rates will have to go up to lure depositors back, or we have to get more indebted to the rest of the world. Hopefully APRA hold their nerve and don't let the banks go on another foreign debt binge.

Without tear away loan growth I don't see how house prices can take off.

One of the under-explored areas of Australia’s post-mining economy, is to what extent credit growth is able to accelerate. By driving towards public surpluses in a current account deficit economy, our pollies are inherently relying upon private credit growth to drive GDP.

The credit growth required to keep house prices running, to keep consumption humming and to keep the services economy investing, is lower than it used to be owing to borrowers paying down their debts faster. However, we will still need to see rising credit growth if the economy is going to be able to rebalance away from mining investment and support current standards of living.

At the moment, RBA credit aggregates have accelerated only modestly with total credit growth running at 4.8% annualised per month or 3.1% year on year:

On the other hand, deposits are growing now at around 6%.

As we know, APRA continues to insist that the banks lend dollar-for-dollar deposits-in, loans-out. It is obvious in the data. The following is a chart of Australian deposit-taking institutions’s assets (loans) to deposits spread:

It hasn’t gone anywhere since 2009 and check out how fast it used to have to grow to keep the housing economy rolling.

What this tells you is that APRA (and ratings agencies) are not letting the banks increase the absolute level of their offshore borrowing to pour into local loans. By extension it caps local credit growth, which can only grow as fast as deposits allow it to.

Where is the cap? It’s impossible to know given households are paying down debt faster than they used to, freeing up new credit capacity in the process. Other variables include off-balance sheet lending such as non-bank loans via securitisation or cash purchases of houses by foreign buyers. There is also the likelihood that deposit growth will fall further as national income comes under pressure with further declines in the terms of trade and interest rates. Nevertheless, a rough calculation says we’re near the cap now now. 4.8% credit growth for the system in the year ahead would add $15 billion in new assets. 6% growth in deposits would add $10 billion. We’re shifting past deposit-funded lending capacity as we speak.

It does not take much to see that $5 billion deficit get much larger. Everything else being equal, if credit growth were to accelerate to 6% and deposit growth fall to 4%, the deficit becomes $12 billion per annum. At 7% and 3% it’s out to $18 billion.

This is a far cry from the heady growth of yesteryear, but it would still represent 4% growth in offshore liabilities per annum.

It think (hope) that this is unlikely. It may be the RBA’s job to boost growth but it’s APRA’s job to protect financial stability and the shift apparent in the above charts looks structural to me. After all, once the borrowing resumes, how is prevented from rising?

looks like either interest rates will have to go up to lure depositors back, or we have to get more indebted to the rest of the world. Hopefully APRA hold their nerve and don't let the banks go on another foreign debt binge.

Without tear away loan growth I don't see how house prices can take off.

One of the under-explored areas of Australia’s post-mining economy, is to what extent credit growth is able to accelerate. By driving towards public surpluses in a current account deficit economy, our pollies are inherently relying upon private credit growth to drive GDP.

The credit growth required to keep house prices running, to keep consumption humming and to keep the services economy investing, is lower than it used to be owing to borrowers paying down their debts faster. However, we will still need to see rising credit growth if the economy is going to be able to rebalance away from mining investment and support current standards of living.

At the moment, RBA credit aggregates have accelerated only modestly with total credit growth running at 4.8% annualised per month or 3.1% year on year:

On the other hand, deposits are growing now at around 6%.

As we know, APRA continues to insist that the banks lend dollar-for-dollar deposits-in, loans-out. It is obvious in the data. The following is a chart of Australian deposit-taking institutions’s assets (loans) to deposits spread:

It hasn’t gone anywhere since 2009 and check out how fast it used to have to grow to keep the housing economy rolling.

What this tells you is that APRA (and ratings agencies) are not letting the banks increase the absolute level of their offshore borrowing to pour into local loans. By extension it caps local credit growth, which can only grow as fast as deposits allow it to.

Where is the cap? It’s impossible to know given households are paying down debt faster than they used to, freeing up new credit capacity in the process. Other variables include off-balance sheet lending such as non-bank loans via securitisation or cash purchases of houses by foreign buyers. There is also the likelihood that deposit growth will fall further as national income comes under pressure with further declines in the terms of trade and interest rates. Nevertheless, a rough calculation says we’re near the cap now now. 4.8% credit growth for the system in the year ahead would add $15 billion in new assets. 6% growth in deposits would add $10 billion. We’re shifting past deposit-funded lending capacity as we speak.

It does not take much to see that $5 billion deficit get much larger. Everything else being equal, if credit growth were to accelerate to 6% and deposit growth fall to 4%, the deficit becomes $12 billion per annum. At 7% and 3% it’s out to $18 billion.

This is a far cry from the heady growth of yesteryear, but it would still represent 4% growth in offshore liabilities per annum.

It think (hope) that this is unlikely. It may be the RBA’s job to boost growth but it’s APRA’s job to protect financial stability and the shift apparent in the above charts looks structural to me. After all, once the borrowing resumes, how is prevented from rising?

Attachments

Well, der.

Rate rises will increase mortgage stress: Fitch

Australian mortgage holders could be hit by future payment shocks as interest rates rise and the unemployment rate lifts, a global ratings agency has warned in a call for lending stress tests.

Banks and other lenders lowered their standard variable rates (SVRs) again this month after the Reserve Bank slashed the cash rate to a historic low of 2.5 per cent.

SVRs are now below 6 per cent, more than 1 percentage point below their average of about 7.5 per cent in the past decade.

Global ratings agency Fitch said stress tests that use rates closer to historical averages would ensure borrowers, in particular first-timers, would be able to maintain their payments as interest rates return to their historical levels.

Advertisement

"SVRs have been as high as 9.6 per cent as recently as September 2008. For example, monthly loan payments would rise to $2544 from $1820 for a home loan of $300,000 should rates return to recent SVR highs," Fitch Ratings' analysts said in a research note yesterday.

Read more: http://www.theage.com.au/business/t...tress-fitch-20130816-2s1ka.html#ixzz2c6z56ftd

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

- Joined

- 6 January 2009

- Posts

- 2,300

- Reactions

- 1,130

below graph shows why changes to NG will never occur.

I suppose the only good thing is there will be plenty of potentil buyers of IPs if a big crash does occur.

I am a bit shocked the jump in IP loans started so long ago

That chart is the exact reason why NG should be removed on existing properties.

The argument for NG has always been it adds to the rental supply, this just not seem to be a fair and balanced statement. It would seem that it does little to add to the rental supply and very little to adding to new rental supply.

It should only on new builds, this would bolster the construction sector while reducing pressure on prices for existing homes for people to live in.

Cheers

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

That chart is the exact reason why NG should be removed on existing properties.

The argument for NG has always been it adds to the rental supply, this just not seem to be a fair and balanced statement. It would seem that it does little to add to the rental supply and very little to adding to new rental supply.

It should only on new builds, this would bolster the construction sector while reducing pressure on prices for existing homes for people to live in.

Cheers

For sure. The problem is your last statement. House prices probably would decline if NG was only on new housing stock. less investor demand = less falling house prices.

But just look at the squealing changes to car FBT caused, and that is affecting less than half the number of NG property owners out there.

NG on new property only, combined with NG on all assetts only able to offset the income on that assett and no other income, I'll glady vote for the party offering to do that.

These major changes to the tax system are probably only achieveable with bipartisan support. I can't see that happening in the climate of negativity we've had.

IP income losss have totalled around the $65B mark (inflation adjusted) since 2000.

I'd say limit the halving of CGT to new assets as well. Allowing it on current assets doesn't increase investment levels, just inflates prices.

Bill M

Self Funded Retiree

- Joined

- 4 January 2008

- Posts

- 2,132

- Reactions

- 740

Prices are just going up here in Sydney, I am so glad I still have an IP there.

---

This time last year they may have been worth far less, but the Sydney market has begun to boom and $1 million or more for a home in an average suburb is now the new normal.

The conditions are perfect for sellers. Buyers are everywhere, thanks to record low interest rates and a severe shortage of listings, pushing price tags beyond what sellers would ever have imagined.

Full Story here: http://www.dailytelegraph.com.au/news/nsw/sydney-homeowners-sitting-on-houses-worth-over-1-million/story-fni0cx12-1226698978104

---

---

This time last year they may have been worth far less, but the Sydney market has begun to boom and $1 million or more for a home in an average suburb is now the new normal.

The conditions are perfect for sellers. Buyers are everywhere, thanks to record low interest rates and a severe shortage of listings, pushing price tags beyond what sellers would ever have imagined.

Full Story here: http://www.dailytelegraph.com.au/news/nsw/sydney-homeowners-sitting-on-houses-worth-over-1-million/story-fni0cx12-1226698978104

---

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

Just reading a report I get for being a member with Macrobusiness

i think this graphs sums up quite nicely why the 150K couple feel poor

Nice to see Howard's spendathon against an RBA raising interest rates got the level of income required to pay mortgage interest back to the recession we had to have levels.

No wonder a lot of people have no money left to spend on retail

Please APRA, don't let the banks borrow more externally.

i think this graphs sums up quite nicely why the 150K couple feel poor

Nice to see Howard's spendathon against an RBA raising interest rates got the level of income required to pay mortgage interest back to the recession we had to have levels.

No wonder a lot of people have no money left to spend on retail

Please APRA, don't let the banks borrow more externally.

Attachments

- Joined

- 20 November 2010

- Posts

- 544

- Reactions

- 2

Prices are just going up here in Sydney, I am so glad I still have an IP there.

---

This time last year they may have been worth far less, but the Sydney market has begun to boom and $1 million or more for a home in an average suburb is now the new normal.

The conditions are perfect for sellers. Buyers are everywhere, thanks to record low interest rates and a severe shortage of listings, pushing price tags beyond what sellers would ever have imagined.

Full Story here: http://www.dailytelegraph.com.au/news/nsw/sydney-homeowners-sitting-on-houses-worth-over-1-million/story-fni0cx12-1226698978104

---

- Joined

- 14 February 2005

- Posts

- 15,374

- Reactions

- 17,750

Inflation in everyday living costs is already becoming significant. Electricity prices alone are having a noticeable impact on the psychology of people it would seem (judging by general comments on the subject) and in most states prices are still going up.I foresee several things happening to the property market in the short term :

- A recovery/uptick in prices due to low interest rates, people rushing to the market, herd mentality

- A period of stagnation where many who bought find the returns/yields to be insufficient and that negative gearing just isn't working as an investment strategy

- Slowing of the economy and employment rising

- Inflation starting to hurt the every day australian with rising costs and no way growth, RBA starts to look to the heavens for another solution

- A turn point in structural beliefs in Australia society that property is a easy investment, everyday business getting tougher, the fit will survive but many have become slow over the last 30 years.

- A slow but steady rush to the gate to offload property for the over indebted.

Now add in the impending gas price rises which will have a significant impact in Vic especially (since gas use is very widespread there - indeed residential use is amongst the highest in the world on a per capita basis).

AUD tending down and the oil price trending slowly up - here comes a rise in petrol prices.

Smoking isn't as popular as it once was, but plenty of people still do it and cigarette prices are set to rise significantly due to taxation. That alone won't break the bank, but it's another price rise that those who smoke are sure to notice.

Now add in everything else from cinema tickets to fish - it's all slowly getting more expensive.

Wage rises? Well the public service is a significant employer and in most states it's more about keeping your job than getting a pay rise. There seems to be a trend there to limit wage rises to below the inflation rate in order to get budgets closer to balanced. Wage rises of 2% per annum and the tax system will take a disproportionate share of that (ie the actual after tax pay increase will be less than 2%). Public sector workers are going nowhere.

A lot of private sector companies seem to be much the same. It's about keeping your job primarily, with any pay rise coming about through promotion rather than an across the board rise as such. There are exceptions of course, but that seems to be the overall trend. Rising unemployment means workers have less bargaining power to seek pay increases.

Then there's other employment-related things like overtime, travel, company cars etc which increase the pay of workers. They are usually the first things to be looked at when seeking to cut costs. Whilst I have no hard data, I do get the impression that cuts in this area are already underway in many places.

So overall it's rising costs for everyday purchases and little if any growth in income for the average worker. That's not going to help confidence once people accept this as reality. In my opinion, falling interest rates are the only thing keeping the game going at the moment - and there's a limit to how far they can fall both in absolute terms and also without crashing the AUD and sending prices (especially petrol) up sharply thus offsetting the effects of the lower interest rate.

So overall I have the impression that we are slowly but surely walking down the path which just happens to be a dead end. It's just that many (the majority?) of people haven't realised this yet and are assuming the path actually leads somewhere. Ultimately it will, but not without a lot of pain first I expect.

Thinking of my own life, I'm not too worried since I own the house outright and have low "essential" living costs. Pay rates, car rego and house / car insurance and buy food. I could pretty much stop spending on everything else for 12 months if I had to and not suffer too much. But looking at the overall employment and economic situation, I'd be extremely worried if I had a huge mortgage, no significant investments and a family to raise and a lot of people are in exactly that situation. I can't imagine they're likely to spend on anything they don't have to - hence a lot of businesses are struggling.

House prices? In real terms they'll come down I'm sure (already have done significantly in my area). The question about nominal values comes down to whether we inflate or not. I suspect that globalisation has effectively put a lid on how much we can inflate wages in Australia these days unless everyone else does the same.

- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

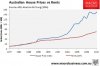

another graph that shows the perverse effect the halving of CGT had in 2000. It's like lift off into space.

The question is, if there's not enough income to support the loan, and the capital growth wont keep pace with inflation and losses, how long before the investors start to decide to sell. Once the selling tide turns I can see it being a scary place to have your money locked up.

The question is, if there's not enough income to support the loan, and the capital growth wont keep pace with inflation and losses, how long before the investors start to decide to sell. Once the selling tide turns I can see it being a scary place to have your money locked up.

Attachments

Similar threads

- Replies

- 21

- Views

- 2K

- Replies

- 3

- Views

- 11K