You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The future of Australian property prices

- Thread starter Joe Blow

- Start date

hello,

no will just let out as normal, who knows the tenant might put in bunk beds

old joint but still in solid condition, windows good, weatherboards sound, stumps good

decorative cornice, reasonable ceiling height, about 600sqM, shed, good neighbours either side

tenant in already, half way through second year there, who is desperate to stay on, plan to get up there by early next year for a tree change brother

thanks

robots

no will just let out as normal, who knows the tenant might put in bunk beds

old joint but still in solid condition, windows good, weatherboards sound, stumps good

decorative cornice, reasonable ceiling height, about 600sqM, shed, good neighbours either side

tenant in already, half way through second year there, who is desperate to stay on, plan to get up there by early next year for a tree change brother

thanks

robots

- Joined

- 18 April 2007

- Posts

- 809

- Reactions

- 0

Official inflation figures haven’t kept up with property prices either: Why not?Income have not kept up with the avergae home loan.

Latest ABS Inflation figures:

http://www.ausstats.abs.gov.au/ausstats/meisubs.nsf/0/F38A42DA428E0160CA2576B6000FFEED/$File/64010_dec%202009.pdf

Notice the inflation figure of 2.1% is an “average” of increases in Food, Alcohol, Clothing, Housing etc. How the hell can the percentage change in Alcohol (amongst other things) be averaged with the percentage change in Housing?

Let’s just assume for this example Alcohol in a year decreased by 5.5%. Let’s compare that to the current HOUSING increase of 5.5%. They would average each other out as a measure of CPI.

If Alcohol cost $1000- in a year and the pretend decrease of 5.5% would conclude with a saving of $55-

HOUSING:

Over the twelve months to December quarter 2009 the housing group increased 5.5%

mainly due to rises in rents (+5.4%), electricity (+15.7%), house purchase (+2.4%) and

water and sewerage (+14.1%).

Last quarter House purchase increased by 2.4% eg: ( $400,000 to $409,600 = $9600 out of pocket)

or what about rents increasing by 5.4% eg: ($20,000 to $21080 = $1080 out of pocket)

How could you drink $21k worth of booze because that’s what was blown on rent? So why do they even partially compared in this way?

The increase in housing costs are not projected with actual cost weightings!

How can an increase of a $1000- in rent be averaged with an estimated saving of $55- in booze cancelling each other out?

How can the ABS’s “cpi” used by the RBA when setting interest rates be expected to control property prices?

They obviously can’t!

The RBA can't control house prices as it hardly even enters their CPI equation. Glenn Stevens doesn’t appear to have the power to do anything about it. IMO we need a 0.5% - 1% rate increase now, but it's simply not going to happen.

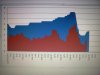

I have a chart which I’ve put together comparing the CPI to the cash rate from mid 2001 to date. The average margin between “CPI” and the “cash rate” before the GFC was 2.55% and now it is 1.46% a loss of more than one percentage point or 40% in margin for savers.Recovery?

By rewarding the profligate and screwing savers and fixed income investors?

This will come at a dire cost later. No! Glen Stevens is looking smarter again.

Here is a "photo" of that chart, like Kincella, I don’t have the software to convert from Excel.

hello,

good morning and a fantastic day ahead

top article:

http://www.theaustralian.com.au/bus...le-into-property/story-e6frg8zx-1225848228175

one of the biggest scams going around Super (unless you in government fund) and many are getting out of it, for anybody under 40 stay clear of it

thankyou

robots

good morning and a fantastic day ahead

top article:

http://www.theaustralian.com.au/bus...le-into-property/story-e6frg8zx-1225848228175

one of the biggest scams going around Super (unless you in government fund) and many are getting out of it, for anybody under 40 stay clear of it

thankyou

robots

- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

Gday Robots.

nice to have you back

sunshine and lollipops brother.

Dont you think using your pad as an upmarket brothel and taking a large cut would be more finacially viable than renting it out to some hippy?

nice to have you back

sunshine and lollipops brother.

Dont you think using your pad as an upmarket brothel and taking a large cut would be more finacially viable than renting it out to some hippy?

just doing some history of property posts on hc...

cannot seem to pull up any before about 2002

they did not always have the different forums ie property

however if I track a poster as below, found more posts

I was looking for around the year 2000 mark...when there was a lot of noise then

but look at this one thread 11.01.04 all doom

'stocko' was one of those who sold his house and was still waiting to get back in...of course he was screaming prices would fall by 50%

sounds like the same posts today

look at the prices, he sold in 2000-median price was 230k, by 2003 =330k, 2004 =390k, 2010 = 545k

http://www.hotcopper.com.au/post_threadview.asp?fid=4&tid=79911&msgno=82236#82236

then this one saying rates would rise to 17% in dec 03

http://www.hotcopper.com.au/post_threadview.asp?fid=4&tid=76838&msgno=79747#79747

may 2002 still predicting a crash

http://www.hotcopper.com.au/post_single.asp?fid=4&tid=1551&msgid=5005

of course he had a following....just like today

actually it is hilarious....they either did not buy back in 2000, or they sold, and just sat back and watched the prices double

and its different again today

cannot seem to pull up any before about 2002

they did not always have the different forums ie property

however if I track a poster as below, found more posts

I was looking for around the year 2000 mark...when there was a lot of noise then

but look at this one thread 11.01.04 all doom

'stocko' was one of those who sold his house and was still waiting to get back in...of course he was screaming prices would fall by 50%

sounds like the same posts today

look at the prices, he sold in 2000-median price was 230k, by 2003 =330k, 2004 =390k, 2010 = 545k

http://www.hotcopper.com.au/post_threadview.asp?fid=4&tid=79911&msgno=82236#82236

then this one saying rates would rise to 17% in dec 03

http://www.hotcopper.com.au/post_threadview.asp?fid=4&tid=76838&msgno=79747#79747

may 2002 still predicting a crash

http://www.hotcopper.com.au/post_single.asp?fid=4&tid=1551&msgid=5005

of course he had a following....just like today

actually it is hilarious....they either did not buy back in 2000, or they sold, and just sat back and watched the prices double

and its different again today

- Joined

- 1 February 2007

- Posts

- 1,068

- Reactions

- 0

Latest ABS Inflation figures:

http://www.ausstats.abs.gov.au/ausstats/meisubs.nsf/0/F38A42DA428E0160CA2576B6000FFEED/$File/64010_dec%202009.pdf

Notice the inflation figure of 2.1% is an “average” of increases in Food, Alcohol, Clothing, Housing etc. How the hell can the percentage change in Alcohol (amongst other things) be averaged with the percentage change in Housing?

As I said on another thread....I'm confused.

Alcohol and cigs have increased......well the government taxes them twice a year, EVERY year don't they? So of course they have increased

- Joined

- 18 April 2007

- Posts

- 809

- Reactions

- 0

Alcohol and cigs have increased......

Ok confusing......

Try again! ........ I’ll stick with the inflation figures as released above.

Between all 11 CPI percentage groups the average is taken to produce the 2.1% increase in inflation. The RBA then adjusts interest rates by monitoring the inflation rate.

Financial and insurance services decreased by 6.3% for the year.

Housing increased by 5.5% for the year.

If these were the only two groups used to produce an inflation figure the official CPI figure would be -0.4%.

My point is the increase in Housing as a cost would far outweigh the decrease in Financial and insurance costs. The rent increase alone of 5.4% would be (approx $1000-) for a lot of families. The savings in the Financial and insurance group would only total (approx $200-) Many end up paying an extra $800- for the year but the CPI figure would still be -0.4%. As the -0.4% figure is calculated by using just the change in percentage of each group.

comments?

- Joined

- 12 February 2009

- Posts

- 623

- Reactions

- 1

comments?

The cost of living is increasing by far in excess of 2%. I would guess it is 5-10%. This is compounded further in that wages and benefits are not increasing by far less than 5%. The RBA would have us believe that they are doing all that the can to counter inflation.

Glenn Stevens' recent unprecedented warnings about the RE market are a VERY clear sign as to how small that gap is between the rock and the hard place. He doesn't want to have to property market collapse by increasing interest rates by as much required (to 8%+), but instead just wishes to slowly cool the overheated market by warning people to borrow less and thus avoid further mortgage stress.

The RE market is in for a major correction, and there is not a thing anybody can do about it.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,453

- Reactions

- 6,513

The RE market is in for a major correction, and there is not a thing anybody can do about it

Yes that's very true.

In fact it has been since 1973 which was the first I heard of it.

WaveSurfer

Manic

- Joined

- 28 March 2009

- Posts

- 219

- Reactions

- 0

As I said on another thread....I'm confused.

Alcohol and cigs have increased......well the government taxes them twice a year, EVERY year don't they? So of course they have increased

Someone once told me that during a financial crisis, the best stocks to invest in are tobacco and alcohol suppliers. Because consumers won't stop spending on those items, while cutting back on almost everything else. I guess those stats prove the theory to be right.

I'm going to check some stock charts to see if it's reflected there.

Oh here you go. This sort of says the same thing

http://money.cnn.com/2008/05/30/markets/thebuzz/index.htmPeople may pull back on discretionary spending when they're wallet is feeling light but they're unlikely to cut back as substantially on basics like food, drinks and household products.

hello,

good morning all, great easter weekend as usual in Australia, chapel st was rocking yesterday with plenty out and about

more reasons why Australia top of the tree in my opinion:

http://www.theaustralian.com.au/new...two-dead-15-hurt/story-fn3dxity-1225849113899

and i opened a new bank account on thursday at CBA but they didnt give me a shotgun like in the United States, whats going on, you get them in the US so you must get one here, ooohh noooo

thankyou

robots

good morning all, great easter weekend as usual in Australia, chapel st was rocking yesterday with plenty out and about

more reasons why Australia top of the tree in my opinion:

http://www.theaustralian.com.au/new...two-dead-15-hurt/story-fn3dxity-1225849113899

and i opened a new bank account on thursday at CBA but they didnt give me a shotgun like in the United States, whats going on, you get them in the US so you must get one here, ooohh noooo

thankyou

robots

- Joined

- 18 April 2007

- Posts

- 809

- Reactions

- 0

The cost of living is increasing by far in excess of 2%. I would guess it is 5-10%............

Glenn Stevens' ......... He doesn't want to have a property market collapse by increasing interest rates by as much required (to 8%+)

Perhaps 8% for property but not 8% for CPI. Remember the RBA's job is to keep the CPI within a target range and property appears to be just a tiny percentage in the CPI mix. The RBA has very little control over property!

IMO the continued warnings from Glenn Stevens voices concerns that when CPI increases so will interest rates. Very little consideration will be given to highly leveraged up property investors. Housing doesn't appear to have enough of the mix in the CPI equation, so what has promoted recent property gains can quickly be undone. If inflation starts getting a grip Glenn Stevens can't help property investors.

I imagine for now the CPI target will be in the RBA's lower range.

The RE market is in for a major correction, and there is not a thing anybody can do about it.

Lets take that comment out of contextYes that's very true.

Bill M

Self Funded Retiree

- Joined

- 4 January 2008

- Posts

- 2,132

- Reactions

- 740

Welcome back robots, nice to see you around mate. I'm up on the Gold Coast right now visiting family, they report that house prices have shot through the roof up here. Houses are put on the market and snapped within a few days and they are getting top prices.hello,

good morning all, great easter weekend as usual in Australia, chapel st was rocking yesterday with plenty out and about

more reasons why Australia top of the tree in my opinion:

Went for a walk along the Burleigh Beach front this morning, full of people excersing and enjoying the wonderful sun. What a nice place this is, could easily live here too...

here is a good article for home buyers and investors...the naysayers will not like it....

in the Uk they have kept acurate records for the past 919 years...

property has increased at a compound rate of over 10% for every one of those years

Australia has kept records, accurate or not for only 120 years with similar results

the article is copyright....but the author is a former Reserve Bank of Sydney economist, and Australia Post, and former treasurer of Telstra

of course some can disregard the info coming from a property investing site

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

graph showing the decline 2007-2010....for those who want to dispute the 10% average rise......by the time it picks up and increases in the future, it will make up for that short period of decline

so history will still record an average growth of 10% in the future...when you look back in hindsight

http://news.bbc.co.uk/2/hi/8386796.stm

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

re the CPI figures

....they are dodgy, all involved know that, a decrease in the price of weetbix, or a tv set is recorded, and increase in interest rates and house prices is excluded...

look back to the Whitam era for a more accurate CPI/ Inflation figure, when the interest cost was included in the CPI and interest rates were around 10-12%,

Whitlam 15%-72-75

Fraser 10% 75-83

Keating 5% 83-96 ******note 1

Howard 2.5% 96-07 *** note 2

note 1..notice the big drop in inflation and CPI, interest was removed from CPI about 89-90, yet interest rates were still high, as in 15.5% to 17% in 89, then 13% in 1991, 10% in 1995

note 2...understandable as interest rates came down from 10% in 95 to an average of 6.5-7% since 1997

http://www.aph.gov.au/library/pubs/rp/2007-08/08rp04.htm#Wages

http://www.loansense.com.au/historical-rates.html

in the Uk they have kept acurate records for the past 919 years...

property has increased at a compound rate of over 10% for every one of those years

Australia has kept records, accurate or not for only 120 years with similar results

the article is copyright....but the author is a former Reserve Bank of Sydney economist, and Australia Post, and former treasurer of Telstra

of course some can disregard the info coming from a property investing site

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

graph showing the decline 2007-2010....for those who want to dispute the 10% average rise......by the time it picks up and increases in the future, it will make up for that short period of decline

so history will still record an average growth of 10% in the future...when you look back in hindsight

http://news.bbc.co.uk/2/hi/8386796.stm

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

re the CPI figures

....they are dodgy, all involved know that, a decrease in the price of weetbix, or a tv set is recorded, and increase in interest rates and house prices is excluded...

look back to the Whitam era for a more accurate CPI/ Inflation figure, when the interest cost was included in the CPI and interest rates were around 10-12%,

Whitlam 15%-72-75

Fraser 10% 75-83

Keating 5% 83-96 ******note 1

Howard 2.5% 96-07 *** note 2

note 1..notice the big drop in inflation and CPI, interest was removed from CPI about 89-90, yet interest rates were still high, as in 15.5% to 17% in 89, then 13% in 1991, 10% in 1995

note 2...understandable as interest rates came down from 10% in 95 to an average of 6.5-7% since 1997

http://www.aph.gov.au/library/pubs/rp/2007-08/08rp04.htm#Wages

http://www.loansense.com.au/historical-rates.html

hello,

thanks Bill M,

great site Kincella:

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

2 time winner of most liveable city, great effort

thankyou

robots

thanks Bill M,

great site Kincella:

http://www.propertyplanet.com.au/cms-investors/why-invest-in-melbourne.phps

2 time winner of most liveable city, great effort

thankyou

robots

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

A very interesting read:

"The result is that, for 919 years, property prices have raised at a compound rate of increase of 10.2% per annum. The Rule of 72 states that any number which increases at 10% p.a. compound, doubles every 7.2 years. So, for over 900 years, property prices in England have been doubling, on average, every 7 years." From the above link.

We had a "Rule of 72" thread here at ASF

https://www.aussiestockforums.com/forums/showthread.php?t=11991&highlight=The+Rule

- Joined

- 28 October 2008

- Posts

- 8,609

- Reactions

- 39

No more interesting than any other spruiker's website.A very interesting read:

A very interesting read:

"The result is that, for 919 years, property prices have raised at a compound rate of increase of 10.2% per annum. The Rule of 72 states that any number which increases at 10% p.a. compound, doubles every 7.2 years. So, for over 900 years, property prices in England have been doubling, on average, every 7 years." From the above link.

We had a "Rule of 72" thread here at ASF

https://www.aussiestockforums.com/forums/showthread.php?t=11991&highlight=The+Rule

Does that mean the GBP has halved every 7 years

Similar threads

- Replies

- 21

- Views

- 2K

- Replies

- 3

- Views

- 11K