You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The future of Australian property prices

- Thread starter Joe Blow

- Start date

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,440

- Reactions

- 6,442

Very

- Joined

- 18 May 2009

- Posts

- 510

- Reactions

- 1

Nice collection of graphs there Mr. Z. Thanks for sharing that.

Interesting results - from 2000 to present, Household Interest Payments have been on a rapid increase, with investor housing declining heavily since 2003 to present.

So average joe is using rapidly increasing amounts of his disposable income to pay off loans, while investors are rapidly reducing their investment levels - am I right in thinking... uh-oh?

Interesting results - from 2000 to present, Household Interest Payments have been on a rapid increase, with investor housing declining heavily since 2003 to present.

So average joe is using rapidly increasing amounts of his disposable income to pay off loans, while investors are rapidly reducing their investment levels - am I right in thinking... uh-oh?

- Joined

- 18 May 2009

- Posts

- 510

- Reactions

- 1

Although that being said disposable income has grown in the last year... so I'm probably overreacting :dunno:

- Joined

- 28 October 2008

- Posts

- 8,609

- Reactions

- 39

Re: The state of the consumer.

http://www.rba.gov.au/publications/fsr/2010/mar/html/contents.html

Latest edition is March 2010. There are some comments in this thread on them, about 300 pages back.

Those graphs look like they are from the RBA's Financial Stability Review.Interesting!

http://www.rba.gov.au/publications/fsr/2010/mar/html/contents.html

Latest edition is March 2010. There are some comments in this thread on them, about 300 pages back.

Attachments

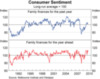

The increase in gearing is interesting and the hours worked seem to be in a constant decline against rising employment. Have we all gone part time? CC accruing interest also on a healthy romp! Some conflicting numbers!

They tell me this RE market is all investors but the house hold credit components say that investor and OO housing credit has been falling for a while, so how is the gap being filled with a rising market. Has volume fallen that much or? Anyone got a existing house sales chart?

They tell me this RE market is all investors but the house hold credit components say that investor and OO housing credit has been falling for a while, so how is the gap being filled with a rising market. Has volume fallen that much or? Anyone got a existing house sales chart?

- Joined

- 18 May 2009

- Posts

- 510

- Reactions

- 1

That household gearing one is nasty

- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

I especially liked the share market vs dwelling prices graph  Not that I am fixated with prices mind you.

Not that I am fixated with prices mind you.

- Joined

- 18 May 2009

- Posts

- 510

- Reactions

- 1

I especially liked the share market vs dwelling prices graphNot that I am fixated with prices mind you.

Yeah it's a good one - I'd go so far as to say if you smooth out the 2004-2010 share market asset prices they're pretty much on par with property!

Still, it's quite amazing how much asset prices have increased since about 1998. Everything was nice and smooth with a slight up trend and bam - exponential growth from there onwards

I especially liked the share market vs dwelling prices graphNot that I am fixated with prices mind you.

Yeah but notice the swings under and over... from a contrarian stand point it is saying look at stocks... FWIW.

- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

Completely concur with statements by Mr Z and KurwaJegoMac. The trick is going to be which one is going to rise and which one is going to fall or even better yet stay stable. House prices to stagnate and sharemarket to continue rising IMO. (must have written this about 30 times so far)

A case point argument could be argued for both. Hey ... wait a minute ... we have already done that ! I have already placed forward my view.

A case point argument could be argued for both. Hey ... wait a minute ... we have already done that ! I have already placed forward my view.

Attachments

I have already placed forward my view.

Yeah... but I am here to talk you around, then if I succeed, get deep concerned by that fact!

hello,

good afternoon, great day

gee quite a few irrelevant posts on the thread today, oh well take the good with the bad in life i guess

thankyou

professor robots

And that`s just added another one. Quite an irrelevant day for some.

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

Mr Z, thanks for the RBA graphs - good data !

- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

Well here is a success story if I ever heard one !

So where does this inspirational woman go from here, “I’m continuing to grow Ccorp to be the largest and most diverse property development company in Australia. I’ve got an assortment of projects in the pipeline, so the next few years are going to be exciting and challenging and we just want to keep giving more! ” Carly said.

To call her an over achiever, would be an understatement, superwoman would be more suitable. (LOLOL at this one)

http://www.ccorp.com.au/about.html

Will be interesting to see if this is "sustainable" ???? Very clever to run seminars that give you a clear head shot at your victims (ahem ... I mean investors) to sell your product to. I have been to several of these property guru seminars and I always come away with the feeling I have been to an AMWAY meeting. Too much Ta-ra-ra - BOOM - dee-ay! for my liking.

Still ...... she has the runs on the board.

So where does this inspirational woman go from here, “I’m continuing to grow Ccorp to be the largest and most diverse property development company in Australia. I’ve got an assortment of projects in the pipeline, so the next few years are going to be exciting and challenging and we just want to keep giving more! ” Carly said.

To call her an over achiever, would be an understatement, superwoman would be more suitable. (LOLOL at this one)

http://www.ccorp.com.au/about.html

Will be interesting to see if this is "sustainable" ???? Very clever to run seminars that give you a clear head shot at your victims (ahem ... I mean investors) to sell your product to. I have been to several of these property guru seminars and I always come away with the feeling I have been to an AMWAY meeting. Too much Ta-ra-ra - BOOM - dee-ay! for my liking.

Still ...... she has the runs on the board.

Will be interesting to see if this is "sustainable" ???? Very clever to run seminars that give you a clear head shot at your victims (ahem ... I mean investors) to sell your product to. I have been to several of these property guru seminars and I always come away with the feeling I have been to an AMWAY meeting. Too much Ta-ra-ra - BOOM - dee-ay! for my liking.

Still ...... she has the runs on the board.

Yes, sustainable? Swimming naked and all that. Not that the bank will let you go over knee deep these days!

Love Amway meets.... it is like traveling to another universe! Planet USA... way too much coffee! Interesting they had a business model that could have used the Internet to leveraged themselves onto a whole new level yet they failed to use it to full advantage. IMO anyway! last time I looked they had all but ignored it... looked like a classic missed opportunity to me back there in the 90's.

BTW, this sort of stuff screams top or close FWIW. Yes I consider a few years close in a market like RE... after all, 6 months round trip is as close as you get to a day trade! Did that once!

Remember that condo flip web site in the US, dedicated to the skill of buying a condo on as long a settlement as you could find and flipping it before you settled! Man that was a trip of a site... I wonder if it is still there? Doubt it somehow!

Watching grass grow... spring is close... boing or boom? No takers on a short term punt? Just for the hell of it, nuthing we can crucify you over? I am going for boing with a slight edge, not a lot in it IMO.

- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

Depends on interest rates. If the banks jack the margin on the wholesale funds due to costing overruns and short supply my money will be on a boing. OR are they just profiteering again? Supposedly the biggest GFC in history and the big 4 are coming out with pregnant profits like never before. They have been rooting someone to get this fat.

Then again spring sale and market confidence may just overcome this fait accompli. Interest rates rising are good right ? Means inflation is going up right? Which means your house price is going up right?

Or are they doing this to take the heat out of the market and cause it to slowly deflate? Stringent lending has taken care of at least 60% of the market already. Another rate rise will tackle at least another 20% of OO's. IMO.

Then again spring sale and market confidence may just overcome this fait accompli. Interest rates rising are good right ? Means inflation is going up right? Which means your house price is going up right?

Or are they doing this to take the heat out of the market and cause it to slowly deflate? Stringent lending has taken care of at least 60% of the market already. Another rate rise will tackle at least another 20% of OO's. IMO.

- Joined

- 30 June 2008

- Posts

- 15,543

- Reactions

- 7,407

Will be interesting to see if this is "sustainable" ???? Very clever to run seminars that give you a clear head shot at your victims (ahem ... I mean investors) to sell your product to. I have been to several of these property guru seminars and I always come away with the feeling I have been to an AMWAY meeting. Too much Ta-ra-ra - BOOM - dee-ay! for my liking.

Still ...... she has the runs on the board.

Now where did we last hear of such a brilliant, successful property developer?? That's right the one and only Henry Kaye who singlehandedly sent property into orbit 10 years ago and left hundreds of investors in outer space and under water. (Don't you love mixed metaphors

Check out his little adventures and count the similarities.

How Henry Kaye fuelled the property boom

September 22, 2003

Related:

- Concern on Kaye apartment deal

Henry Kaye led investors into the Oasis development with promises of discounted prices and no money down, write James Button and John Garnaut.

Galina Smith remembers her husband's excitement when he walked into their home in Kareela, in Sydney's southern suburbs. Colin Smith, a truck driver who runs his own delivery company, had been to a property investment seminar that night and met an "enthusiastic, dynamic young man" called Henry Kaye.

Kaye, Australia's best-known property investment guru, had told Smith and the rest of the audience about the huge profits to be made in property. And if they wanted to get started he could find the right properties for them. Soon one of Kaye's consultants visited the couple. Galina was troubled - the consultant pushed hard and the promise of quick wealth seemed too easy - but eventually the Smiths agreed.

http://www.theage.com.au/articles/2003/09/21/1064082867568.html

Similar threads

- Replies

- 21

- Views

- 2K

- Replies

- 3

- Views

- 11K