Anyone got any thoughts on the following??

Article from:* Dow Jones Newswires

THE US economy is likely to enter into a depression and the "implosion" of the Chinese economy will cause disastrous consequences for the whole world, Societe Generale strategist Albert Edwards said.

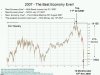

Advising investors to "bail out" of their stock investments now, Mr Edwards, whose super-bearish stance on the global economy proved correct last year, predicted another 40 per cent decline in the S&P 500 index caused by dismal profit reports and poor economic data during the first half of this year.

"In 2009 it is not the mounting risk of depression in developed economies that will come as a major surprise," Mr Edwards wrote in a note to clients, "it is economic implosion in China and the global and geopolitical risk thereof."

Over a year ago, Mr Edwards had predicted the US would enter into a deep recession because of the excessive amount of debt it had accumulated.

Saying recent data points to "something far worse than deep recession," Mr Edwards' forecast for 2009 marked an even more bearish shift in his outlook for the global economy, and a further departure from the mainstream of economic strategists who expect a US economic recovery in the second half of the year.

In forecasting a depression in the US, Mr Edwards means that he believes the US will see a peak-to-trough decline in its gross domestic product of more than 10 per cent.

In China, Mr Edwards expects the worst domestic upheaval since the Tiananmen Square protests in 1989 may cause the Chinese authorities to undertake a "mega-devaluation" of the Chinese currency, the yuan, in an effort to stay in power, as "the very survival of the regime depends on growth".

A devaluation of the yuan would cause the rest of the world's economies to competitively devalue their own currencies in response, Mr Edwards said, sparking a "1930's-style trade war" that "could see a rerun of the Great Depression".

Mr Edwards bases his forecast for an implosion of the Chinese economy on several technical factors.

He points to data showing China's electric power output declined over the last three months. The data usually correlates with China's GDP.

He also noted the sharp decline during recent months in the Organisation for Economic Co-Operation and Development's leading growth indicator for China's economy.

Mr Edwards said reasonable explanations for the decline in China's electric power output, such as the effect of a switch to oil-based power, were belied by sharp declines in industrial production growth and export levels in other Asian economies.

Article from:* Dow Jones Newswires

THE US economy is likely to enter into a depression and the "implosion" of the Chinese economy will cause disastrous consequences for the whole world, Societe Generale strategist Albert Edwards said.

Advising investors to "bail out" of their stock investments now, Mr Edwards, whose super-bearish stance on the global economy proved correct last year, predicted another 40 per cent decline in the S&P 500 index caused by dismal profit reports and poor economic data during the first half of this year.

"In 2009 it is not the mounting risk of depression in developed economies that will come as a major surprise," Mr Edwards wrote in a note to clients, "it is economic implosion in China and the global and geopolitical risk thereof."

Over a year ago, Mr Edwards had predicted the US would enter into a deep recession because of the excessive amount of debt it had accumulated.

Saying recent data points to "something far worse than deep recession," Mr Edwards' forecast for 2009 marked an even more bearish shift in his outlook for the global economy, and a further departure from the mainstream of economic strategists who expect a US economic recovery in the second half of the year.

In forecasting a depression in the US, Mr Edwards means that he believes the US will see a peak-to-trough decline in its gross domestic product of more than 10 per cent.

In China, Mr Edwards expects the worst domestic upheaval since the Tiananmen Square protests in 1989 may cause the Chinese authorities to undertake a "mega-devaluation" of the Chinese currency, the yuan, in an effort to stay in power, as "the very survival of the regime depends on growth".

A devaluation of the yuan would cause the rest of the world's economies to competitively devalue their own currencies in response, Mr Edwards said, sparking a "1930's-style trade war" that "could see a rerun of the Great Depression".

Mr Edwards bases his forecast for an implosion of the Chinese economy on several technical factors.

He points to data showing China's electric power output declined over the last three months. The data usually correlates with China's GDP.

He also noted the sharp decline during recent months in the Organisation for Economic Co-Operation and Development's leading growth indicator for China's economy.

Mr Edwards said reasonable explanations for the decline in China's electric power output, such as the effect of a switch to oil-based power, were belied by sharp declines in industrial production growth and export levels in other Asian economies.