- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Thank you Peter, yes just have to bite the bullet in this type of volatile market conditions. Also sold BRU so there is very little exposure to the market in my portfolio now.@aus_trader Good work on the sell. I know it's tough to do but you knew it had to be done. Most of your edge in this type of trading is due to the money management.

Hi willoneau,I just read your thread and am interested what the aim of it is?

Is it to log your trading like a journal ?

or seek some guidance

or even just get stock tips ?

Thanks mate, energy related stocks are doing OK at the moment, so let's see how BUL goes... Some even getting taken over like Santos Ltd (STO).I bought some BUL today and yesterday as well @ .125.. Good Luck

After 2 years of flat share price movement, one of Australia's favourite home-builder's Simonds Group Ltd (SIO) seems to be coming back to life. There seems to be a few things going for it:

- Went back to profitability from a -ve profit the previous year

- New CEO seems to be driving growth

- Reduced debt on it's books

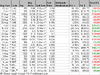

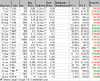

Open Portfolio:

View attachment 87873

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.