- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Does anyone know an easy way to ride the digital currency or Crypto craze? When I say easy I mean rather than buying individual digital currencies, can you buy an ETF or LIC that are heavily invested in Cryptos?

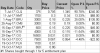

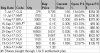

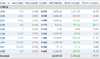

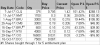

I've been looking into this area and reading other forums on it and on the ASX I found 1 stock that is involved with digital currencies. So bought some Digitalx Ltd (DCC) to add to this bunch of speculative stocks.

I've been looking into this area and reading other forums on it and on the ASX I found 1 stock that is involved with digital currencies. So bought some Digitalx Ltd (DCC) to add to this bunch of speculative stocks.