- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Bubs Australia Ltd (BUB) was sold and I've added a dividend/distribution paying fund to my Medium/Longer Term Stock Portfolio, details in that thread...

After holding for nearly 3 months, sold Capitol Health Ltd (CAJ) for a loss. There is a dividend coming up on 26th of September, I'm not comfortable losing any more capital on this one. Not easy finding winners these days...

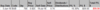

Closed Positions:

View attachment 89067

It's been tough going this year in the speculative space, you are right. But my aim is to be consistent and also keep capital preservation in mind when investing. I know there has been a few good stocks (such as RHP, ASX, APT) to have been in but I would have had to cast a wider net i.e. buy many more stocks to find a few winning stocks to hold on to. Would have had to cut out many losers too along the way though since winners are very rare.Sold my CAJ recently also. They're either not working efficiently or can't convince the investing community that they are.

If it was easy then everyone would do it and that would make it hard again. The losers try something else (hoard gold) and that makes it easy for the few who stick to it.

Looking through your results I see that you're having a difficult 2018. We both know that there have been lots of great trending stocks this year. Have you wondered why you haven't had many in this portfolio? (Or were they all in the BIG portfolio).

Bruce Lee is one of my all time favourites by the way...For what it's worth, I think it's very tough investing in small/micro companies.

The only chance of making serious money, or any money, out of them is if you've done serious research into each of them.

By research, I mean talking to the manager, the contractors, consultants, the technician, the lady in the office. Really, really know what they're about.

From having that kind of detailed understanding, I think an investor could then make informed decision. And more likely to make a fortune or two with getting in on the ground floor and what not.

To get in from financial statements, managerial presentation or projections... armchair warrior stuff... It's going to be pretty tough for a couple of reasons.

One, the business might very well be legitimate. But business is tough, very difficult to get the funding and the product/services right, the marketing etc. Then there's the big boys who can pretty much crush you before you could walk.

So when there's sizzles, the market will tend to boost the stock skyhigh. The moment there's a bad rumour or a set back, it's a race for the exit.

Pretty tough to know when to go against the crowd so you'd just go with them to be save. Can't make money doing that, i don't think.

Second, I think established companies.. or at least ones that's profitable, pure play etc., They could do very, very well too if you can pick them right, or lucky enough to find them.

Just my thoughts.

Thanks Peter, I'll also look into ONX to keep in a watchlist. Since Re-listing after company name change, it has made great progress and just last month poured the first gold from Comet Vale JV project. Would be good to see the financials of their operation as they continue to report...In spite of my opinion and reluctance there are several gold producers showing excellent chart trends. AMI is OK, but ONX is better.

Me too. My record is bad as well in the past with most mining plays not just gold. I've mentioned about this in my earlier posts about getting buried alive in the GFC days. Hopefully it's made me a more nimble, humble person. So I haven't thrown the towel in but continue to learn and become better at investing / trading.Like you, I've been reluctant to trade gold stocks while the price of gold falls. My reluctance is also due the fact that I've got a lousy record with them.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.