galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,363

- Reactions

- 2,169

Hey all, I am fiddling around with screening along the lines that David Dreman describes in his book, "Contrarian Investing Stategies" and I am struggling to find accurate data.

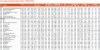

Basically I want to select a universe of companies like the ASX500, and then screen for the 100 with the lowest p/e, or p/b or p/fcf or debt/equity or the 100 with the highest yield.

I found https://au.investing.com/stock-screener/ but the data is hopelessly out of date.

I want p/e based on eps from last AR and most recent sp.

I would prefer to be able to create an exportable portfolio so I can play with it in excel - and the site I linked does that well, just that the data is useless!

I dont mind if I have to pay, just want to know it works before I shell out!

Basically I want to select a universe of companies like the ASX500, and then screen for the 100 with the lowest p/e, or p/b or p/fcf or debt/equity or the 100 with the highest yield.

I found https://au.investing.com/stock-screener/ but the data is hopelessly out of date.

I want p/e based on eps from last AR and most recent sp.

I would prefer to be able to create an exportable portfolio so I can play with it in excel - and the site I linked does that well, just that the data is useless!

I dont mind if I have to pay, just want to know it works before I shell out!