greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,505

- Reactions

- 4,633

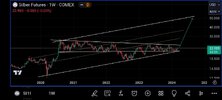

Outperformed gold which was interesting. Perhaps the industrial use of silver is giving it an edge.

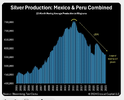

Could be. The fundamentals for silver have been strong for some time now with soaring demand and supply deficits. I think silver has been held back for a long time and over the next few years will move higher as mining production and refining costs increase due to higher inflation.

I'm firmly in the silver supply squeeze camp with supply being unable to keep up with demand and that imbalance driving the price higher.