greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,505

- Reactions

- 4,633

More than 70% of the production of Silver is as a byproduct from mining other minerals ( Source) ,I have seen lot of discussion about silver demand on various media platforms and also the silver production deficit that started in 2021 and has amounted to a total of 474Moz since then. But I haven't seen much discussion about silver production AISC, which seems to me to be a pretty critical part of the equation.

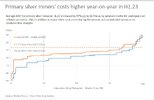

I came across the 2023 Interim Silver Market Review, published on 15 November 2023 by The Silver Institute. I had suspicions that the high inflation over the last couple of years has probably had a material effect on the cost of silver production but had not been able to find up-to-date data until I found this report which contained the following slide:

View attachment 168879

A few thoughts:

With 2023 AISC up 57% to US$17 per oz y/y as compared to 2022 it is clear that inflation has had a material impact on silver production costs. It is also interesting to note that the average silver spot price in 2023 is very similar to the average spot price in 2022. With silver AISC rising but the spot price not seeing similar gains, this would be putting financial pressure on a lot of silver miners whose production costs are at the higher end of the costs scale. It seems logical to conclude that without an equivalent rising silver spot price it is likely that global production with continue to decline as some miners find their production becoming uneconomic as rising costs continue to squeeze margins.

It seems almost inevitable that in an environment of rising silver demand, declining production and rising silver mining production costs that we should see the silver spot price rise at some point in the short to medium term, especially if inflation continues to push silver mining AISC higher.

More than 70% of the production of Silver is as a byproduct from mining other minerals ( Source) ,

so for those mines its a bit difficult to work out the AISC for silver, unless they apportion some of the costs associated with extraction to the silver component. Even if the costs get high, it may not necessarily mean curtailment, as the other minerals/metals may be profitable.

I hope like hell that there is a big run on silver, I have a bit of skin in the game, but sometimes ya just have to sit back and ask a few hard questions.

mick

That's an interesting point about more than 70% of silver production being a byproduct of mining other minerals. I wonder then about the cause of the 474 million ounce silver deficit in the last two years. Is it a result of a decline in copper, lead and zinc mining over that time where silver was produced as a byproduct, a decline in silver production overall, or just a shortage of large projects with substantial silver deposits?

The silver market is an incredibly complex one that is difficult to comprehend at times. The rabbit hole goes very deep. I'll do some more research and see what I can come up with.

I struggle to get my head around some of the complex (and highly suspicious) finacial instruments surrounding silver.The silver market is an incredibly complex one that is difficult to comprehend at times. The rabbit hole goes very deep. I'll do some more research and see what I can come up with.

I struggle to get my head around some of the complex (and highly suspicious) finacial instruments surrounding silver.

Herse i a neat explantion of the seemingkly contradictory position of there being a very subdued investment grade product inventory, lease rates, hedging, price and physical production.

The writer also predicts some sort of structural upheaval is going to take place that seems counterinyuitive.

As he says, we will have to wait and see,

Chinese and Mexican Mines Are Running Out of Silver

June 28, 2023 by Michael Maharrey

Silver demand set a record in every category in 2022 and is expected to continue growing. Meanwhile, silver production flatlined. Record global silver demand and a lack of supply upside contributed to a 237.7 million ounce market deficit in 2022.

The trends indicate that this deficit will expand in the next several years as demand continues to surge as supply begins to shrink, and there are some concerning trends indicating supply may contract rapidly in the coming years.

We’ve reported on the increasing demand, especially in the solar energy industry. An Australian study concluded that solar panel production could require most of the silver reserves by 2050. But there are also looming pressures on the supply side.

Mine output in several key countries is falling. According to a paper published in China and translated at ZeroHedge, in 2020, China had 41,000 tons of proven silver reserves in the ground. At the current mining rate, that left only about 11 years of remaining silver as of 2020.

"By 2032, China’s underground silver deposits will be fully depleted, leading to resource extinction."

China ranks among the top five silver consumers globally. The country charted an average annual silver demand of 6,300 tons over the last 10 years. Chinese mines produce about 3,350 tons each year, meaning the country already imports about half of its silver. If Chinese mine production falls as predicted, Chinese demand will put further strain on the global silver supply.

"From 2033 onwards, China’s static silver demand of 6,300 tons will rely entirely on imports, exacerbating the global imbalance between silver supply and demand."

There are similar concerns about Mexican silver mine output.

Mexico is currently the world’s leading silver producer. As of 2020, its silver resource reserves were estimated to be 37,000 tons. At the current mining pace, its reserves will be exhausted by 2026.

The list below displays the projected timeline of silver resource extinction given known reserves in the top 10 silver-producing countries. This is based on USGS data calculated in 2020.

United States: 25 years

Chile: 19 years

China: 11 years

Mexico: 6 years

Poland: 53 years

Peru: 26 years

Bolivia: 19 years

Australia: 67 years

Russia: 24 years

Other countries: 15 years

"As a result of the silver resource extinction in China, Mexico, and other major silver producers, global annual silver supply will plummet by 15,450 tons. In other words, by 2036, global silver production will dip below 10,000 tons, while demand will continue to exceed 30,000 tons."

Of course, this timeline could stretch out with the discovery of new silver deposits and technological advances that allow miners to reach metal in more difficult places. But the overall trajectory signals falling mine production in the years ahead.

Given the supply and demand dynamics, it appears that silver is significantly underpriced.

I hope you are correct.News regarding silver supply is almost exclusively that mine output is decreasing in an environment of increasing supply. A typical article is like the one below:

Chinese and Mexican Mines Are Running Out of Silver

Silver demand set a record in every category in 2022 and is expected to continue growing. Meanwhile, silver production flatlined. Record global silver demand and a lack of supply upside contributed to a 237.7 million ounce market deficit in 2022. The trends indicate that this deficit will expand...schiffgold.com

There seems to be a lot of vested interests in silver, specifically those who are heavy in physical and want to see silver go on a bullish run, and those knee deep in paper silver contracts who only have an interest in price, not the metal itself. There is also endless talk of price manipulation, mostly those holding physical accusing banks and other financial institutions of conspiring to keep the silver price artificially low.

But I can't shake the feeling that silver's time is almost here and we could see some significant price movement in the coming few years. I think precious metals is going to be one of the most interesting areas of the investment world as we work our way through the current decade.

Silver is intrinsic to industrial demand in sectors such as electronics, medicine etc. in fact, more than half of all silver consumption is for industrial purposes.

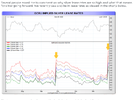

I'd agree @gregglesSilver trading lower and coming into contact with support around US$22.25 for about the sixth time in the last 12 months.

The direction of the $US seems to be the determinative factor. If the $US continues to rise silver will break down through support. If the $US falls, the silver price will bounce.

View attachment 170409

Is their a way to make a dollar out of silver atm.?Silver is in a paradoxical position at the start of 2024. On the one hand, industrial demand for the precious metal continues to grow, particularly from the solar and electrification sector, and supply remains constrained. On the other hand, total demand actually fell 10% in 2023, and prices remained stuck around $23 per ounce as the year drew to a close.

Silver investors may be wondering how these two things can be true at once, and what it will take for the gray metal’s price to finally take off. According to Peter Krauth, editor of SilverStockInvestor and author of The Great Silver Bull, the situation is complex, but the outlook for 2024 and beyond remains very favorable, with the Fed set to provide even more upside than current projections are accounting for.

“To me, it's not the end of the world,” Krauth said of this year’s drop in demand. “What I think is more important, if you want to get a one-number perspective on what's going on, is to look at the deficit, and the deficit is still high. It's not an all-time high, but it's still the second highest on record. In fact, if you add together the deficits of the last three years, it's nearly half of the entire supply for this year.”

I'd agree @greggles

I see no reason to look at silver stocks this year. This is from Kitco.com in January 24

Is their a way to make a dollar out of silver atm.?

gg

It's a murky world.There seems to be a lot of vested interests in silver, specifically those who are heavy in physical and want to see silver go on a bullish run, and those knee deep in paper silver contracts who only have an interest in price, not the metal itself. There is also endless talk of price manipulation, mostly those holding physical accusing banks and other financial institutions of conspiring to keep the silver price artificially low.

But I can't shake the feeling that silver's time is almost here and we could see some significant price movement in the coming few years. I think precious metals is going to be one of the most interesting areas of the investment world as we work our way through the current decade.

The last six weeks were a good time to buy if you are stacking physical. Well done to those who managed to add to their stack under US$23. US$22 looks to be solid support.

Friday's price action looks very bullish but as I've learned with silver, reversals can be quick and brutal. Lets see what next week brings.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.