Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

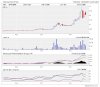

It's going to be a significant day for RAU today I think. It is worth noting that citicorp sold down about 36m shares to take their stake from abt 12% to abt 6%.

That evening star still bothers me a bit. The third leg, the big down day was overdone a bit and accounts for a little rise back before another down day yesterday.

If good assays are posted today I think the price will probably hold above .20, but if they don't get those assay results sorted out and reported this morning, I can see the last of the DT's moving on and the price coming down further... maybe even to .10 to .12 area.

That would be my cue to get back in.

That evening star still bothers me a bit. The third leg, the big down day was overdone a bit and accounts for a little rise back before another down day yesterday.

If good assays are posted today I think the price will probably hold above .20, but if they don't get those assay results sorted out and reported this morning, I can see the last of the DT's moving on and the price coming down further... maybe even to .10 to .12 area.

That would be my cue to get back in.