MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

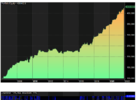

Yup appreciate Frog. But wow, that period from 2011 to 2016 would be a seriously real test of stamina and system faith. Not sure many would stick with the system that long.For anyone wondering, I will reallocate some of the daily assets (aka money) into a new weekly trend system I have been reviewing lately;

a review of my failed Mother Of All initiative adding a few of the Dump it discussed indicators and learnings since

It is XAO based, relatively conservative and has good backtest not only on the recent time (critical for me) but also in much longer period (since 2006 : @MovingAverage will appreciate)

more importantly, it is a low DD and VERY smooth curve ; not a killer performance wise but hopefully will pay its keep

below graph not compounded (same parcel numbers and size):

View attachment 136275

both volatility daily systems will remain paused as well as DL Guppy ; this frees $100k and I will allocate 50k to the new WkMOA and keep the rest for crash opportunities and to buy load of breads

It is a shame I can not let the 2 volatility daily systems run as they have been done for these times but i can not ensure I will have internet access daily and so could risk VERY big loss in a chaotic market .

I will carry existing DLBO as long as possible and liquidate before flying out

let's have a great week end and digest NYSE tonight action