Hi,

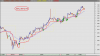

I made my first technical analysis trade (well... of my own analysis anyway) on SSM the other day in at 60c.

Any thoughts from you guys on the trade/chart would be great to see if im getting the grasp.

I guess its a ascending triangle on declining volume... basically...

I made my first technical analysis trade (well... of my own analysis anyway) on SSM the other day in at 60c.

Any thoughts from you guys on the trade/chart would be great to see if im getting the grasp.

I guess its a ascending triangle on declining volume... basically...

below on UNX chart.

below on UNX chart.