You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Potential & Breakout trading--Technical tips and tricks

- Thread starter tech/a

- Start date

REY and LNC behaved as expected.

Thanks Tech/A.

I'm looking for a S/P over $3.00 by Christmas with hopefully some good news by then. How likely do you see that occuring?

BTV in my eyes is looking like an ideal trade set up. A nice rising wedge formation.

Volume has dropped off too.

When was that taken from?

Didn't they change the code to SHD a month ago?

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

Thanks Tech/A.

I'm looking for a S/P over $3.00 by Christmas with hopefully some good news by then. How likely do you see that occuring?

If it plays out to the Weekly wave count then its likely--keep reveiwing

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

BRM

Nice suprise.

Hoping on the breakout and getting hit by the train.

Technical buy Fundamental train!

Nice suprise.

Hoping on the breakout and getting hit by the train.

Technical buy Fundamental train!

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

Excellent, well done tech/a.

I love one of the comments on the BRM thread "I did'nt see that one coming".

The charts tell the story again.

I love one of the comments on the BRM thread "I did'nt see that one coming".

The charts tell the story again.

- Joined

- 29 June 2006

- Posts

- 1,458

- Reactions

- 0

When was that taken from?

Didn't they change the code to SHD a month ago?

yeh they did, sorry. Only just found that out this morning while on ASX. But the chart is the same

- Joined

- 10 February 2006

- Posts

- 456

- Reactions

- 153

BRM

Nice suprise.

Hoping on the breakout and getting hit by the train.

Technical buy Fundamental train!

Interested in how some of you handle takeover price re-ratings from a trading rules perspective. It's one time where a trailing/technical stop is possibly not the best exit criteria.

I usually close my position at market simply because I don't have a trading rule that considers the fundamental pros/cons of the takeover announcement.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

Shoes I trail a stop 50% of the range of the breakout bar from close to high.I'll move the stop up as a new high is made.If a clear new pivot low is made then that's where the final trailing stop will go.

If stopped and a new high is made I'll buy back in with the closest pivot low as the stop.

USA I like the Set up and opportunity for a nice close stop and position sizing.

low volume rising (I have found) has less of a tendency to have a volatile swing back on you.

NSE is very similar but not the stand out

If stopped and a new high is made I'll buy back in with the closest pivot low as the stop.

USA I like the Set up and opportunity for a nice close stop and position sizing.

low volume rising (I have found) has less of a tendency to have a volatile swing back on you.

NSE is very similar but not the stand out

Attachments

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

Sorry I'll correct the GLARING error in the BRM chart.

My trailing stop is $5.40---50% retracemment of the gap plus high of yesterdays bar.

Thought the sharpies would have caught this error!

My trailing stop is $5.40---50% retracemment of the gap plus high of yesterdays bar.

Thought the sharpies would have caught this error!

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

First is CAH, its still hanging in there as nice swing trade setup and it has also popped up in my Metastock scan as a 'look at me' pattern.

(Note to self - remind tech/a when it breaks out)

Don't hold your breath tech/a, could be a while before I get back to you

Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

ARH on a roll.

Iron ore hopefull with possibly Australias richest man in control Clive Palmer.

Big volume and big jump must be on alot of radars today.

Iron ore hopefull with possibly Australias richest man in control Clive Palmer.

Big volume and big jump must be on alot of radars today.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

ARH on a roll.

Iron ore hopefull with possibly Australias richest man in control Clive Palmer.

Big volume and big jump must be on alot of radars today.

Lot to like about this.

If you missed it today like I did I expect an inside day on Monday and more opportunity later.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

ARH

Low volume pullback

I expect 50-61.8% pullback.

25-27.5c

Boggo

mine are

BTU*

CPL

DML

INQ*

JMS

MSB

YTC

PUN

ARH (Pending Stop order)

* Time and Gain stop prospects.

If they dont move X by time Y then Out they go.

Low volume pullback

I expect 50-61.8% pullback.

25-27.5c

Boggo

mine are

BTU*

CPL

DML

INQ*

JMS

MSB

YTC

PUN

ARH (Pending Stop order)

* Time and Gain stop prospects.

If they dont move X by time Y then Out they go.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

* Time and Gain stop prospects.

If they dont move X by time Y then Out they go.

I too have adopted that attitude recently, too many good movers popping up, no point in tying up funds while sitting just above a stop on something that cannot make its mind up when other opportunities are presenting themselves.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

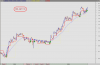

Just for something to do while watching the rain pouring down outside

Three charts, two different analysis methods, two different time periods, three potential buy opportunities but all on the same stock.

I am not going to go into detail on my method as that has been covered on the first page of this thread.

First chart is an EW analysis scan result. Basically this software works backwards and finds potential setups, in this case a TS3 which is a generic ABC pattern (usually a wave 2 or 4).

(The entry quantity etc are automatically produced based on my settings of a $20k account controlled by a 2% risk)

The second chart recent action has an entry in late Oct stopped out in mid Nov, then another entry just after the entry shown on the first chart. That entry has remained intact using the same stop as the first chart and has been followed by two more signals (note the volume - one for tech/a to expand on )

)

The breakout I expected happened on Fri and the heads up was on Thursday's bar imo.

My weekend weekly scan has brought up chart three.

This chart shows potential for a breakout but also an area of potential resistance.

Where to from here, we wait and see. I just thought it would be an interesting sequence to post on this thread.

(click to expand)

Three charts, two different analysis methods, two different time periods, three potential buy opportunities but all on the same stock.

I am not going to go into detail on my method as that has been covered on the first page of this thread.

First chart is an EW analysis scan result. Basically this software works backwards and finds potential setups, in this case a TS3 which is a generic ABC pattern (usually a wave 2 or 4).

(The entry quantity etc are automatically produced based on my settings of a $20k account controlled by a 2% risk)

The second chart recent action has an entry in late Oct stopped out in mid Nov, then another entry just after the entry shown on the first chart. That entry has remained intact using the same stop as the first chart and has been followed by two more signals (note the volume - one for tech/a to expand on

The breakout I expected happened on Fri and the heads up was on Thursday's bar imo.

My weekend weekly scan has brought up chart three.

This chart shows potential for a breakout but also an area of potential resistance.

Where to from here, we wait and see. I just thought it would be an interesting sequence to post on this thread.

(click to expand)

Attachments

- Joined

- 10 February 2006

- Posts

- 456

- Reactions

- 153

ARH

Low volume pullback

I expect 50-61.8% pullback.

25-27.5c

Took off again today on volume ( I hold). My existing positions continue to do well, but my scans have been turning up bugger all last two weeks.

Similar threads

- Replies

- 141

- Views

- 33K

- Replies

- 64

- Views

- 18K

- Replies

- 20

- Views

- 9K

- Replies

- 9

- Views

- 5K