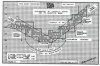

M/W

What are the numbers on the chart and the Bars to the right.

Months of the Year --- 1 is Jan through to 9 is Sep

A is Oct B is Nov C is Dec and 1 is now Jan 2009

What part do they play in your analysis?

A very Important part see the two charts

It appears with the 45 degree lines that we are at an important point now?

Yes, Very possible major Turning Point

P&F has dynamic time scale = the intrinsic movement

The charts really do have velocity and acceleration.

Because the waves of buying and selling do !

A sneaking Bull is exactly that

note the 2005 chart The months prior crowd together

Some months can not even get posted

The waves have receded -- built down

( so look at a 10pt chart like I am now )

Look at the spacing of the months current...

What drives a wide fast and active market and what does it facilitate ?

What drives a narrow slow and dull market and what does it facilitate ?

This is tape reading

P&F is a record of the dynamic of the tape

It is the actual voice of the tape ( The market )

I will update the 10 pt chart later

We have had a good move up from the congestion

and now are at important test

Also Time is important in comparative studies

and Relative Strength Studies..

There are (only ) waves of buying and selling

They have a price range , They have volume , and they have Time ( as Duration )... They reveal what we need to know ...

All you know about what you call VSA is same principles as P&F

eg looking for absorption on the 10 pt chart

Because the chart has an objective scale ( squared grid )

relationships remain as we zoom in or out

The trend lines do really measure acceleration and velocity

congestion is really congestion etc

A Wyckoff trader ( at least this one ) uses P&F like you use EW

in conjunction with VSA....

principles like impulse confluence etc very similar..

motorway