Snake

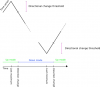

Here is an example

map in time.... The high being . on Mon Tues or next Friday

changes all aspects of the chart

because no longer is each point 100% constrained by the preceding

you have introduced a foreign body (clock) time.

Now map in intrinsic time ( how real life is lived by the way )

By discretization by price

and the high is defined 100% by preceding ( and succeeding) points

what the clock says will never alter a trend line

only the "events"

This is why diagonal forecasting lines ( their original name it seems)

could be drawn at 45 degrees ( only later where they called support and resistance lines )

The chart is a "squared" chart of "events"

These events betray their character by being mapped

in their intrinsic time..

I came across a large brown snake last week ( true )

I was on a narrow path about 1/2 a meter

I watched him in intrinsic time

If he moved I wanted to move first

it was the "events" that were important

I did not use a 1 min scale and because there was no movement

switch to a daily..

If you are defining time by "events"

you have all time frames by having none

The scale is in the moment

time is intrinsic

it moves or not

there is amounts of work

or not

Time is movement and duration

and has real effect

cause and effect

( The name Wyckoff practitioners give to the "Figure" chart )

Why is forecasting important

Because we all do it and have to do it

Will take an action for the utility

We choose to participate even passively

Because of something..

follow trends why ?

Buy and Hold why ?

Why enter even randomly

because we forecast something good has some probability.

and we choose to participate

rather than not.

motorway

Here is an example

map in time.... The high being . on Mon Tues or next Friday

changes all aspects of the chart

because no longer is each point 100% constrained by the preceding

you have introduced a foreign body (clock) time.

Now map in intrinsic time ( how real life is lived by the way )

By discretization by price

and the high is defined 100% by preceding ( and succeeding) points

what the clock says will never alter a trend line

only the "events"

This is why diagonal forecasting lines ( their original name it seems)

could be drawn at 45 degrees ( only later where they called support and resistance lines )

The chart is a "squared" chart of "events"

These events betray their character by being mapped

in their intrinsic time..

I came across a large brown snake last week ( true )

I was on a narrow path about 1/2 a meter

I watched him in intrinsic time

If he moved I wanted to move first

it was the "events" that were important

I did not use a 1 min scale and because there was no movement

switch to a daily..

If you are defining time by "events"

you have all time frames by having none

The scale is in the moment

time is intrinsic

it moves or not

there is amounts of work

or not

Time is movement and duration

and has real effect

cause and effect

( The name Wyckoff practitioners give to the "Figure" chart )

Why is forecasting important

Because we all do it and have to do it

Will take an action for the utility

We choose to participate even passively

Because of something..

follow trends why ?

Buy and Hold why ?

Why enter even randomly

because we forecast something good has some probability.

and we choose to participate

rather than not.

motorway

.

.