Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,304

- Reactions

- 11,583

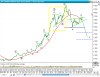

OSH still in recovery mode from the PNG fallout. Looks like the market has totally factored this into the sp now and is returning to favour. Higher lows since Sep last year. Breaking these resistance lines will be tough, especially with the market volatility and POI going no where. MACD confirming that momentum is up and just about to break zero line is positive. I see it getting to the green circle on this current trajectory, but will need POI to 65 or the discovery of an elephant to get through....Having said that, I'm still waiting for the market to sort itself out before I buy another dip.

(holding)

(holding)