- Joined

- 31 May 2006

- Posts

- 1,941

- Reactions

- 2

continued ...

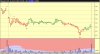

2:50 - moved down through the 28:30 level. Most of the volume in the queue ran away as it touched it. 28.30 level (and my daily

28.32 level) should now act as resistance. This is a good supply - moderate supply pushed it through the 28.30 level and we haven't seen much renewed demand here. This is strengthening the viewpoint that there is a genuine lack of demand. With the close coming in we might start to see a bit of supply come in.

2:55 Ok its moved fairly decisively down through this 2.32 point (currently sitting on the 28.30 level on the bid) so we'll move our trailing stop down to 28.37 as mentioned above.

2:57 - it moved back up through 28.30 and touched 28.32 again on prety small volume - this will be a good test of this resistance now.

2:58 - back down through on a wide ranging red bar with an upper tail - with a bit of volume - bar closed at 28.29 - ths is confirming that there is little support now at this level and its becoming resistance.

2:59 - this is nice - a green bar same range as previous down bar closed on its high on good volume (more volume than previous) - so demand appeared but failed to beat supply - supply is starting to show its hand.

3:00 - no range moderate volume price 28.29 - still confirming some supply and some demand and supply winning.

Checking 5 min bars - the 2:50 p.m. 5 minute bar is showing nice volume and really showing this move down through that support area - was potential stopping volume but subsequent bars have shown it was supply and supply overcame demand.

3:01 - back to 1 minute bar. 3:01 - another high volume test of the resitance point but failed to close above it (closed on 28.30).

3:02 - now made it through the resitance point and closed on 28.31(the 5 min bars will be showing this differently and will be probably starting to show this as possible demand coming in).

3:03 low volume low range no demand no supply - demand isn't appearing as it moves through this resistance.

3:04 - down through the resistance again on moderate volume - the resistance didn't turn into support - there is still no real demand. Little bit of supply but not massive took it back down through here and has moved it down to 28.26 - this is good for a continued move to the downside (imo) - battle over support by the buyers was a weak battle and easily won (and now has been won imo - that resistance at 28.30 should start to become stronger).

3:05 - moving down on volume now - the supply is starting to appear - close at 28.24

3:06 - good volume - high volume bar and down to 28.20 - look out for demand entering but just looks like supply starting to appear properly to me.

3:07 - more down moves on volume - range not as large - volume the same still getting supply but also demand.

3:08 - some demand apearing but after such a quick move down its to be expected - moderate volume and only just matched supply (test to the downside on moderate volume) - possible short term reversal here but not enough volume to signal a turning point to me.

3:09 - this is more positive stuff - moderate volume bar still at these lows no demand entering even though price has spiked down and supply still continuing

This spike is good and possible capitulation so this might be a good point to take a profit if we see any reversal but while its still moving down we'll stay in it.

3:10 - lowest close on high volume - possibly seeing demand come in but its been low volume all day - it could just be supply amping up a bit.

3:12 - demand starting to match supply.

3:13 - supply won the previous bar but volume was high - coming into possible reversal here.

3:14 - green bar - lower volume than previous down bar and full range is higher - possible reversal now - demand beating supply.

3:15 - this is an important bar - its a down bar, but volume is lower than the down bar two bars back and its failed to breach that earlier bars low - the next bar will be significant.

3:16 - no demand - no range bar on low of previous - short view stil intact.

3:17 - little downside test didn't bring any supply or demand.

3:18 - upside test - big volume big range - shows demand but also supply there - closed on high, but will demand follow through.

(stop moved down to the 28.32 level by the way because we're well below it now - and we're also looking for an exit on reversal).

3:19 - no range, no volume - no supply came in at this higher level - demand starting to appear.

Close trade. 3:21 p.m. 28.19

Trade closed but just following through for a bit - 3:25 p.m. - bit of supply here but not much and subsequent bars showing no supply. No re-entries here at the moment - this could have reversed - we're near the close of day as well.

2:50 - moved down through the 28:30 level. Most of the volume in the queue ran away as it touched it. 28.30 level (and my daily

28.32 level) should now act as resistance. This is a good supply - moderate supply pushed it through the 28.30 level and we haven't seen much renewed demand here. This is strengthening the viewpoint that there is a genuine lack of demand. With the close coming in we might start to see a bit of supply come in.

2:55 Ok its moved fairly decisively down through this 2.32 point (currently sitting on the 28.30 level on the bid) so we'll move our trailing stop down to 28.37 as mentioned above.

2:57 - it moved back up through 28.30 and touched 28.32 again on prety small volume - this will be a good test of this resistance now.

2:58 - back down through on a wide ranging red bar with an upper tail - with a bit of volume - bar closed at 28.29 - ths is confirming that there is little support now at this level and its becoming resistance.

2:59 - this is nice - a green bar same range as previous down bar closed on its high on good volume (more volume than previous) - so demand appeared but failed to beat supply - supply is starting to show its hand.

3:00 - no range moderate volume price 28.29 - still confirming some supply and some demand and supply winning.

Checking 5 min bars - the 2:50 p.m. 5 minute bar is showing nice volume and really showing this move down through that support area - was potential stopping volume but subsequent bars have shown it was supply and supply overcame demand.

3:01 - back to 1 minute bar. 3:01 - another high volume test of the resitance point but failed to close above it (closed on 28.30).

3:02 - now made it through the resitance point and closed on 28.31(the 5 min bars will be showing this differently and will be probably starting to show this as possible demand coming in).

3:03 low volume low range no demand no supply - demand isn't appearing as it moves through this resistance.

3:04 - down through the resistance again on moderate volume - the resistance didn't turn into support - there is still no real demand. Little bit of supply but not massive took it back down through here and has moved it down to 28.26 - this is good for a continued move to the downside (imo) - battle over support by the buyers was a weak battle and easily won (and now has been won imo - that resistance at 28.30 should start to become stronger).

3:05 - moving down on volume now - the supply is starting to appear - close at 28.24

3:06 - good volume - high volume bar and down to 28.20 - look out for demand entering but just looks like supply starting to appear properly to me.

3:07 - more down moves on volume - range not as large - volume the same still getting supply but also demand.

3:08 - some demand apearing but after such a quick move down its to be expected - moderate volume and only just matched supply (test to the downside on moderate volume) - possible short term reversal here but not enough volume to signal a turning point to me.

3:09 - this is more positive stuff - moderate volume bar still at these lows no demand entering even though price has spiked down and supply still continuing

This spike is good and possible capitulation so this might be a good point to take a profit if we see any reversal but while its still moving down we'll stay in it.

3:10 - lowest close on high volume - possibly seeing demand come in but its been low volume all day - it could just be supply amping up a bit.

3:12 - demand starting to match supply.

3:13 - supply won the previous bar but volume was high - coming into possible reversal here.

3:14 - green bar - lower volume than previous down bar and full range is higher - possible reversal now - demand beating supply.

3:15 - this is an important bar - its a down bar, but volume is lower than the down bar two bars back and its failed to breach that earlier bars low - the next bar will be significant.

3:16 - no demand - no range bar on low of previous - short view stil intact.

3:17 - little downside test didn't bring any supply or demand.

3:18 - upside test - big volume big range - shows demand but also supply there - closed on high, but will demand follow through.

(stop moved down to the 28.32 level by the way because we're well below it now - and we're also looking for an exit on reversal).

3:19 - no range, no volume - no supply came in at this higher level - demand starting to appear.

Close trade. 3:21 p.m. 28.19

Trade closed but just following through for a bit - 3:25 p.m. - bit of supply here but not much and subsequent bars showing no supply. No re-entries here at the moment - this could have reversed - we're near the close of day as well.