- Joined

- 29 January 2006

- Posts

- 7,222

- Reactions

- 4,452

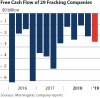

Maybe this is a partial explanation:Oil rig count down to 789 from 800 this week.

"The larger universe of fracking companies suffered even worse results, as a wave of corporate bankruptcies (not captured in this sample) wiped away billions of additional dollars in debt and equity. Since 2015, 174 North American oil and gas producers have filed for bankruptcy protection, restructuring nearly $100 billion in debt, largely through write-offs."