You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OEL - Otto Energy

- Thread starter havingfun

- Start date

-

- Tags

- oel otto energy

- Joined

- 15 November 2006

- Posts

- 1,206

- Reactions

- 679

Re: OEL - Ottoman Energy

Did anyone read the research report recently released on their website? Massive target price.

Does anyone know why it's under a trading halt today?

Did anyone read the research report recently released on their website? Massive target price.

Does anyone know why it's under a trading halt today?

Re: OEL - Ottoman Energy

Yes I like the "presently trading 80% below our base valuation" bit

I'm assuming the TH is related to a farmin somewhere ?

Should be a beauty for the big oil targets.

If its a takeover ......................... this computer will be going through the window this time monday morning.

http://www.ottoenergy.com/investorCentre/reports.php.

Yes I like the "presently trading 80% below our base valuation" bit

I'm assuming the TH is related to a farmin somewhere ?

Should be a beauty for the big oil targets.

If its a takeover ......................... this computer will be going through the window this time monday morning.

http://www.ottoenergy.com/investorCentre/reports.php.

- Joined

- 15 November 2006

- Posts

- 1,206

- Reactions

- 679

Re: OEL - Ottoman Energy

Suspended from trading at the request of the company....

Merger? Takeover? Big discovery?

I'm being optimistic.

Suspended from trading at the request of the company....

Merger? Takeover? Big discovery?

I'm being optimistic.

Re: OEL - Ottoman Energy

Yes surely something other than a fund raising

I hope they hurry up coz I've just got home from work and need to go to bed

Suspended from trading at the request of the company....

Merger? Takeover? Big discovery?

I'm being optimistic.

Yes surely something other than a fund raising

I hope they hurry up coz I've just got home from work and need to go to bed

Re: OEL - Ottoman Energy

Morning fellow Ottomen,

Turkey progressing well

Check out the thumper trucks in the sunflower fields.

Cool.

http://aspect.comsec.com.au/asxdata/20070822/pdf/00750897.pdf

Morning fellow Ottomen,

Turkey progressing well

Check out the thumper trucks in the sunflower fields.

Cool.

http://aspect.comsec.com.au/asxdata/20070822/pdf/00750897.pdf

Re: OEL - Ottoman Energy

Evening all, thought I better wave the flag just so I don't think I'm the only one on here

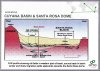

Good read, still accumulating - Argentina news soon

http://www.ottoenergy.com/investorCentre/displayArticle.php?articleID=368

Evening all, thought I better wave the flag just so I don't think I'm the only one on here

Good read, still accumulating - Argentina news soon

http://www.ottoenergy.com/investorCentre/displayArticle.php?articleID=368

Re: OEL - Ottoman Energy

You've got company now JTB - after plenty of Research, I'm in on this one as well...I like the look of the management, the future strategy of Otto and at present think it's undervalued if - as I think will be the case - Argentina comes to fruition.

You've got company now JTB - after plenty of Research, I'm in on this one as well...I like the look of the management, the future strategy of Otto and at present think it's undervalued if - as I think will be the case - Argentina comes to fruition.

Re: OEL - Ottoman Energy

Boy o boy, doesn't this recent interest in Nido highlight the value inherent in OEL's Phillipines permit

NDO

910,000,000 shares with current fund raising to raise $11million dollars

Seismic to be completed

50% SC 58

60% SC 54

50% SC 63

22% of 2P reserves 23.5 mmstb (5.17 mmbbls)

Commence production next year

Same fairway as OEL and chasing analogues of the giant Malampaya field (Shell).

OEL

210 million shares

12m cash and seismic already completed

99% SC 50

80% SC 51

85% SC55

99% 2P reserves of 5.9 mmbbls

Producing next year (not counting gas in Turkey)

This from todays ann' (from recent seismic program and analogous to Malampaya)

Table 1 - Prospective Resource Estimates of

Marantao Prospect made by Otto Energy

Low Case Base Case High Case Mean Case

Case 1

Assuming only Oil 320 MMbbls 1,058 MMbbls 2,682 MMbbls 1,323 MMbbls

Case 2

Assuming only Gas 721 bcf 2,339 bcf 5,605 bcf 2,828bcf

Case 3

Assuming large gas cap

over a 50m oil column

as in Malampaya.

468 bcf +

144MMbbls

1,508 bcf +

469 MMbbls

3,602 bcf +

1,118 MMbbls

1,812 bcf

+567 MMbbls

This form of volumetric assessment is classified as “Prospective Resources” by the Society of

Petroleum Engineers and World Petroleum Congress reserve definitions. Volumetric

estimates of Prospective resources or “potentially recoverable hydrocarbons” were calculated

for three case scenarios; oil only, gas only and a combination of oil and gas fill.

NDO market cap @ 28c - $ 255 million

OEL market cap @ 28c - $ 58 million

http://aspect.comsec.com.au/asxdata/20070921/pdf/00761393.pdf

Boy o boy, doesn't this recent interest in Nido highlight the value inherent in OEL's Phillipines permit

NDO

910,000,000 shares with current fund raising to raise $11million dollars

Seismic to be completed

50% SC 58

60% SC 54

50% SC 63

22% of 2P reserves 23.5 mmstb (5.17 mmbbls)

Commence production next year

Same fairway as OEL and chasing analogues of the giant Malampaya field (Shell).

OEL

210 million shares

12m cash and seismic already completed

99% SC 50

80% SC 51

85% SC55

99% 2P reserves of 5.9 mmbbls

Producing next year (not counting gas in Turkey)

This from todays ann' (from recent seismic program and analogous to Malampaya)

Table 1 - Prospective Resource Estimates of

Marantao Prospect made by Otto Energy

Low Case Base Case High Case Mean Case

Case 1

Assuming only Oil 320 MMbbls 1,058 MMbbls 2,682 MMbbls 1,323 MMbbls

Case 2

Assuming only Gas 721 bcf 2,339 bcf 5,605 bcf 2,828bcf

Case 3

Assuming large gas cap

over a 50m oil column

as in Malampaya.

468 bcf +

144MMbbls

1,508 bcf +

469 MMbbls

3,602 bcf +

1,118 MMbbls

1,812 bcf

+567 MMbbls

This form of volumetric assessment is classified as “Prospective Resources” by the Society of

Petroleum Engineers and World Petroleum Congress reserve definitions. Volumetric

estimates of Prospective resources or “potentially recoverable hydrocarbons” were calculated

for three case scenarios; oil only, gas only and a combination of oil and gas fill.

NDO market cap @ 28c - $ 255 million

OEL market cap @ 28c - $ 58 million

http://aspect.comsec.com.au/asxdata/20070921/pdf/00761393.pdf

Re: OEL - Ottoman Energy

With some luck we may be marching back to old highs

Some good solid buying going through today- I was a bit wary about the single 600k @ 31c seller's motives but he appears to have bolted or got steamrolled.

With some luck we may be marching back to old highs

Some good solid buying going through today- I was a bit wary about the single 600k @ 31c seller's motives but he appears to have bolted or got steamrolled.

Attachments

- Joined

- 12 April 2007

- Posts

- 999

- Reactions

- 0

Re: OEL - Ottoman Energy

Thanks JTB

Have you ever looked at KIK?

It is a partner with NDO in the Phillipines and currently 21.5c.

I think its all time high is 28.5c.

cheers

Thanks JTB

Have you ever looked at KIK?

It is a partner with NDO in the Phillipines and currently 21.5c.

I think its all time high is 28.5c.

cheers

Re: OEL - Ottoman Energy

Hey Bud,

They were YGL weren't they?

Glanced at them some time ago but decided on OEL due to the high % of ownership. (YGL's MC was/is also)

Plus I like the near term prospect in Argentina on a risk/cost/reward basis,

and the near term cash flow from Turkey @ >$7 mcf US.

I also like the fact that OEL have already raised cash and done their seismic (and there share structure is still nice and tight <210 million) plus the fact that the Top 20 hold over 50%.

Have been buying OEL steadily for nearly 12 months now and fully expect them to be trading around the dollar region before next xmas.

To put that into context that will equate with CVN's MC at present .

.

Cheers

Thanks JTB

Have you ever looked at KIK?

It is a partner with NDO in the Phillipines and currently 21.5c.

I think its all time high is 28.5c.

cheers

Hey Bud,

They were YGL weren't they?

Glanced at them some time ago but decided on OEL due to the high % of ownership. (YGL's MC was/is also)

Plus I like the near term prospect in Argentina on a risk/cost/reward basis,

and the near term cash flow from Turkey @ >$7 mcf US.

I also like the fact that OEL have already raised cash and done their seismic (and there share structure is still nice and tight <210 million) plus the fact that the Top 20 hold over 50%.

Have been buying OEL steadily for nearly 12 months now and fully expect them to be trading around the dollar region before next xmas.

To put that into context that will equate with CVN's MC at present

Cheers

- Joined

- 20 September 2007

- Posts

- 1

- Reactions

- 0

Re: OEL - Ottoman Energy

It has gone into trading halt today. Any ideas what the news might be? Maybe related to Argentina.

It has gone into trading halt today. Any ideas what the news might be? Maybe related to Argentina.

Re: OEL - Ottoman Energy

G'day Gordon,

Should be Argentina related but could be anything?

Still got >5 mil in the bank.

If not santa rosa related I'm betting JV

http://aspect.comsec.com.au/asxdata/20071023/pdf/00772938.pdf

It has gone into trading halt today. Any ideas what the news might be? Maybe related to Argentina.

G'day Gordon,

Should be Argentina related but could be anything?

Still got >5 mil in the bank.

If not santa rosa related I'm betting JV

http://aspect.comsec.com.au/asxdata/20071023/pdf/00772938.pdf

Re: OEL - Ottoman Energy

Otto acquires an 18.28% interest in the Galoc Oil Field,

offshore Philippines

Highlights:

• Otto Energy has entered into agreements to acquire an 18.28% interest in

the Galoc Field offshore Philippines, via acquisition of a 31.38%

shareholding in Galoc Production Company WLL (GPC)

• GPC is operator and holds 58.29% equity in the Galoc Field

• Gaffney Cline, an independent reserves assessor, has certified gross 2P

reserves of 23.4 MMbbls for the Galoc Field

• The Galoc Field is currently under development with “first oil” anticipated

in April 20

I hold both OEL andf NDO, did not that see that coming....

good news for both

consolidation of Philippines explores.

Otto acquires an 18.28% interest in the Galoc Oil Field,

offshore Philippines

Highlights:

• Otto Energy has entered into agreements to acquire an 18.28% interest in

the Galoc Field offshore Philippines, via acquisition of a 31.38%

shareholding in Galoc Production Company WLL (GPC)

• GPC is operator and holds 58.29% equity in the Galoc Field

• Gaffney Cline, an independent reserves assessor, has certified gross 2P

reserves of 23.4 MMbbls for the Galoc Field

• The Galoc Field is currently under development with “first oil” anticipated

in April 20

I hold both OEL andf NDO, did not that see that coming....

good news for both

consolidation of Philippines explores.

Re: OEL - Ottoman Energy

Morning gents,

Astounding announcement this morning,

NDO is capitalised at 6 times Otto's value and they've (OEL) just bought the same % share in the GALOC field

Finally we'll see some catch up in cap' me thinks

Post issue OEL will be looking at $1.00 SP for a comparable cap' purely on the GALOC stake.

See previous post regarding valuations prior to this ann'.

Giddyup

Morning gents,

Astounding announcement this morning,

NDO is capitalised at 6 times Otto's value and they've (OEL) just bought the same % share in the GALOC field

Finally we'll see some catch up in cap' me thinks

Post issue OEL will be looking at $1.00 SP for a comparable cap' purely on the GALOC stake.

See previous post regarding valuations prior to this ann'.

Giddyup

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Re: OEL - Ottoman Energy

Hi jtb, the capital raising at 30 c will be available to the public do you think?You are right in comparison to NDO.OEL much more upside as the situation presently stands.

Morning gents,

Astounding announcement this morning,

NDO is capitalised at 6 times Otto's value and they've (OEL) just bought the same % share in the GALOC field

Finally we'll see some catch up in cap' me thinks

Post issue OEL will be looking at $1.00 SP for a comparable cap' purely on the GALOC stake.

See previous post regarding valuations prior to this ann'.

Giddyup

Hi jtb, the capital raising at 30 c will be available to the public do you think?You are right in comparison to NDO.OEL much more upside as the situation presently stands.

Re: OEL - Ottoman Energy

Hey whatyousee,

The last time we got to participate in a SPP was early last year (pre- AP taking the chair at OEL).

I think from the way that international investors have come on board since, I would imagine they may just place the lot?

The chinese mob that are building the production boat (for Caluit) had to buy their substantial stake on market and I think that many other institutions will see the enormous potential the SP offers at these levels.

I bought more today just in case and have averaged my buy price up to just over 30c.

If you look back in the thread you’ll see my comparison of OEL to NDO purely on Phillipines assets and after todays announcement the inherent value has swing even further to Otto imo.

If the market values NDO @ nearly $400 million on its Galoc stake and (Malampaya type) exploration potential then apples for apples that values OEL @ $1.00 per share after Otto issue another 200 million shares.

As OEL also has Caluit (which contains 2P reserves of the same magnitude again- and likely to double) due to come into production Q3 then we can probably stick another conservative 50c per share on there.

The gas resource/production from Turkey that was to fund their Argentine/Phillipines exploration will likely be sold off to Incremental now (imo) due to the income from Galoc? Off the top of my head this will probably bring in $10-20 mil.

This would then fund the entire program (>10 holes) on the monster Santa Rosa target (also see above).

Success here and we’re talking mega $

RM research’s valuation on OEL was $1.80 per share prior to todays ann,’ so my figures above are probably pretty conservative.

If we look at CVN back when they had <500 million shares and I thought they were good value from 8c - 20c on 4 million bbl 2P and upside.

They were valued then at more than OEL are now .

.

Today CVN have nearly 700million shares and Ted’s resource/exploration upside (underpinning valuations of 70c per share) was somewhere around 25mmbbls 2P (CVN share).

At 50c CVN have a market cap of $350 million. This has been driven from a couple of thousand barrels (nett) per day and exploration potential.

OEL will be receiving 3,000 bbl/per day nett from Galoc and Caluit is expected to come on @ 15,000 bbl/per day perhaps as soon as 3 months later.

OEL’s exploration upside is in the 100’s of million bbls in not only the Phillipines but again in Argentina.

At 40c OEL’s market cap is $80 million., post issue it will be 160 million.

When compared to CVN, we should be > 80c per share just on Galoc.

Is I said, bought more today just in case, but will participate in the SPP if it makes it down to us .

.

Hi jtb, the capital raising at 30 c will be available to the public do you think?You are right in comparison to NDO.OEL much more upside as the situation presently stands.

Hey whatyousee,

The last time we got to participate in a SPP was early last year (pre- AP taking the chair at OEL).

I think from the way that international investors have come on board since, I would imagine they may just place the lot?

The chinese mob that are building the production boat (for Caluit) had to buy their substantial stake on market and I think that many other institutions will see the enormous potential the SP offers at these levels.

I bought more today just in case and have averaged my buy price up to just over 30c.

If you look back in the thread you’ll see my comparison of OEL to NDO purely on Phillipines assets and after todays announcement the inherent value has swing even further to Otto imo.

If the market values NDO @ nearly $400 million on its Galoc stake and (Malampaya type) exploration potential then apples for apples that values OEL @ $1.00 per share after Otto issue another 200 million shares.

As OEL also has Caluit (which contains 2P reserves of the same magnitude again- and likely to double) due to come into production Q3 then we can probably stick another conservative 50c per share on there.

The gas resource/production from Turkey that was to fund their Argentine/Phillipines exploration will likely be sold off to Incremental now (imo) due to the income from Galoc? Off the top of my head this will probably bring in $10-20 mil.

This would then fund the entire program (>10 holes) on the monster Santa Rosa target (also see above).

Success here and we’re talking mega $

RM research’s valuation on OEL was $1.80 per share prior to todays ann,’ so my figures above are probably pretty conservative.

If we look at CVN back when they had <500 million shares and I thought they were good value from 8c - 20c on 4 million bbl 2P and upside.

They were valued then at more than OEL are now

Today CVN have nearly 700million shares and Ted’s resource/exploration upside (underpinning valuations of 70c per share) was somewhere around 25mmbbls 2P (CVN share).

At 50c CVN have a market cap of $350 million. This has been driven from a couple of thousand barrels (nett) per day and exploration potential.

OEL will be receiving 3,000 bbl/per day nett from Galoc and Caluit is expected to come on @ 15,000 bbl/per day perhaps as soon as 3 months later.

OEL’s exploration upside is in the 100’s of million bbls in not only the Phillipines but again in Argentina.

At 40c OEL’s market cap is $80 million., post issue it will be 160 million.

When compared to CVN, we should be > 80c per share just on Galoc.

Is I said, bought more today just in case, but will participate in the SPP if it makes it down to us