- Joined

- 3 July 2009

- Posts

- 27,638

- Reactions

- 24,526

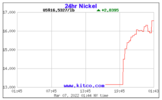

Not much more needs to be said. This is craziness!

Russia's Norilsk has 20% of the nickel market and I don't think anyone wants to touch further dealings with them until the Ukranian fiasco is sorted out.Agreed, but when will the insanity stop? I've got copper, some lithium but no nickel currently. I don't want to chase these higher prices but they keep going higher.

Agreed, but when will the insanity stop? I've got copper, some lithium but no nickel currently. I don't want to chase these higher prices but they keep going higher. We've seen the huge rallies in MCR and NIC. Now PAN has jumped up.

I've been watching (not trading!) JJN.

View attachment 138596

I don't know where the price of nickel will go, but i've been bullish on MCR for a couple of years now.

not withstanding their market cap (1.085B) ....I still think there is more room for a sp increase. They have agreements with BHP and operations have started. Elon Musk will take as much green nickel as he can get. Dividends should see a comeback and the company will stay in profit for quite a while if the price of nickel holds. If the world keeps away from Russian nickel for the foreseeable future, I can't see why MCR can't hit the highs of the earlier part of the century, $4.00 at least and possibly $5.00.

The next problem I have is buying the dips and watching the cycle, as all commodities eventually fall and i have no reason to believe nickel is any different

ImhoProbably need to rationalise some of these Nickel threads.

Might be a good day for Ni miners on Monday.

View attachment 138648

View attachment 138647

I think one of the dumbest decisions made by any company last year WRT its shareholders was made by WSA.

I think one of the dumbest decisions made by any company last year WRT its shareholders was made by WSA.I just checked the shares, public holiday over here in the West, PAN 30c 30million shares traded, you little ripper. ?Apparently Nickel does not recognise the numbers 14, and 15, so one trading day later here we are at 16+:

I think one of the dumbest decisions made by any company last year WRT its shareholders was made by WSA.

Today I reckon it would be trading at over $5 instead of being trapped by a board decision to sell to IGO for a bargain basement price.

Little wonder so many shareholders are pissd off by ridiculously high director's fees and share allocations, when they put us last.

Hmmm...

Is Ni up.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.