- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

Nickel presently trading at a 10 year high:

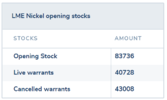

Inventories are also dropping quickly:

BHP is likely to do well, anticipating around 90K tonnes in FY22. Plus BHP has produced the first nickel sulphate crystals from its nickel sulphate plant at Kwinana. The nickel sulphate plant is an Australian-first and will produce 100,000 tonnes of nickel sulphate per year when fully operational. 85% of BHP nickel goes to the EV market.

Inventories are also dropping quickly:

BHP is likely to do well, anticipating around 90K tonnes in FY22. Plus BHP has produced the first nickel sulphate crystals from its nickel sulphate plant at Kwinana. The nickel sulphate plant is an Australian-first and will produce 100,000 tonnes of nickel sulphate per year when fully operational. 85% of BHP nickel goes to the EV market.

Last edited: