- Joined

- 3 July 2009

- Posts

- 27,638

- Reactions

- 24,527

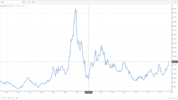

It would be interesting to know what the LME reserve of nickel is, they seem to have stopped publishing it, but 6_12 months ago it was getting very low.Interesting price spikes in some nickel stocks last week. MCR, NIC, SGQ, BSX.

Not supported by the major nickel producers, WSA, IGO.

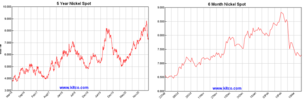

Kitco price charts for nickel show a recent rally off yearly low.

View attachment 105075

Edit: Almost forgot to mention that Sth American production of nickel and other base metals have been significantly cut by corona virus outbreaks and subsequent lock downs of mining sites. (ie production cuts not just happening to iron ore producers)