Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

What do you think about the value of utilising new technology in your analysis? It’s easy to accept the value of new technology on the execution side, imagine a world without internet brokers…but what about the new technologies in analysis?

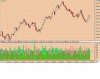

Is an OHLC bar or candlestick that updates every “x" minutes the best of analysis technology for traders using technical analysis? Does anyone see value in using constant volume bars, range bars, change bars, market profile, footprint charts, tick charts? Can any of these improve existing analysis, or add new, more valuable forms of analysis to your toolkit? As an aside, does using these show up some of the inadequacies in ASX reporting of time and sales and perhaps suggest that trading different markets than the ASX could be attractive?

Any thoughts?

Is an OHLC bar or candlestick that updates every “x" minutes the best of analysis technology for traders using technical analysis? Does anyone see value in using constant volume bars, range bars, change bars, market profile, footprint charts, tick charts? Can any of these improve existing analysis, or add new, more valuable forms of analysis to your toolkit? As an aside, does using these show up some of the inadequacies in ASX reporting of time and sales and perhaps suggest that trading different markets than the ASX could be attractive?

Any thoughts?