moneyneversleeps said:In the medium to long run I never worry about the US, they control just about all technologies and industries worth controlling including IT and even space etc. How can they lose?

Just to note I removed that quote whilst I was checking it, the correct figure I was looking at was the account deficit as percentage of GDP which is -6.3%. This is only behind Spain, Portugal, Greece, New Zealand, Iceland, and Cyprus.

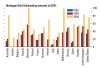

Seeing as I'm hogging another post, our mortgage debt as a % of GDP is very large, meaning any downturn *could* have as large effect on our major banks as any of those areas that starting to have large problems (US, UK, Spain, Ireland)