- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Monthly update. This has been the most profitable month I had in 6 and a half years; my second daughter was born a couple of weeks ago, a 3.5kg investment. The dividends are a little smelly, but high growth is expected. OK, enough puns, I am just very happy. But, I had almost no time to look at shares or respond on the forum. This will continue for some time but should gradually improve.

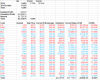

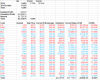

Portfolio has declined a further $1,038.60 (2.1%) for the month.

Portfolio has declined a further $1,038.60 (2.1%) for the month.