tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,464

- Reactions

- 6,570

Posting up the results of a third party trading system that worked well for a period is hardly seeking feedback for your trading ideas, perceptions, doubts or technical prowess in the real market.

More like promoting something.

What are you on about. THIRD PARTY?????

I designed it!!

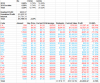

Worked well!!! 30K to $386K in 7 yrs peaked at $450K

There were 1000s of posts around 15 threads.

Heaps of feedback all sorts of great discussion.

What the hell is there to promote.

It was and still is free to anyone who wants it.