- Joined

- 22 August 2008

- Posts

- 914

- Reactions

- 20

Hi KTP,

You know I come in and have a bit of a look in your thread every so often, ask some (hopefully) thought provoking questions for you and then bunk off. So there is a couple of things I wanted to raise with you, and of course I'll do it by voicing a few questions... Remember these aren't for me, I come in here to try and assist you achieving clarity in your process.

I've said before KTP that it's very nice to see someone who laid out their thoughts and yet was still able to converse with those who had differing viewpoints. This appears to remain the same during your thread. It's important to never lose this, no matter how good you get at this thing called investing...we are forever learning...

So first question...have you changed/tweaked anything in your rules due to your now +1 year of direct experience?

This leads to what IMO is the most important aspect of investing....evaluation. Whether you were successful or not it is important to objectively evaluate our performance against some kind of standard. Would you please rate your performance against the following standards?

Did you have fun?

1) What is this thing called fun?

5) Wooh! All funned out.

Did you learn and improve?

1) What? er?

5) Nosce te ipsum to the max!

Did you set correct goals?

1) I didn't get my gold toilet seat!!!

5) I was within a hairs breath of where I thought I would be.

Let's talk about CAB, our last posts on the subject are back on posts 340-350 Disclaimer: I currently don't hold CAB

Ahh you can tell from the above I took my profit out of the trade...here were my words back then

Background

I entered on the 4th of July at $4.1457 for 18,000 units, in accordance with a positional sizing model I use. At that time my target from a technical perspective was $4.50, the point of significant horizontal resistance. This is not a take profit level, merely where I anticipated that the stock would find some price resistance.

In the immediate term however I still have a short-term unsustainable compound curve...meaning that I anticipate a retracement or consolidation in the share price...but only in the short-term. I am therefore faced with a choice. I can take my profit now and then attempt to purchase once again at the bottom of the retracement level, or I can anticipate a retracement will occur, set an appropriate stop level and look to see whether the longer-term emergent pattern is revealed.

Ok so I exited the stock @ $5.7225 for a $28,382.40 profit or ~38% net profit (we had almost the same level of performance).

I asked you about the level of CAB before you'd consider it again...and of course we've also had some changes to the fundamental influences...

So as a little bit of a thought experiment...what are your thoughts in relation to them now?

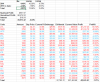

BTW here's a chart...even though I now you don't like them.

Cheers

Sir O

You know I come in and have a bit of a look in your thread every so often, ask some (hopefully) thought provoking questions for you and then bunk off. So there is a couple of things I wanted to raise with you, and of course I'll do it by voicing a few questions... Remember these aren't for me, I come in here to try and assist you achieving clarity in your process.

I've said before KTP that it's very nice to see someone who laid out their thoughts and yet was still able to converse with those who had differing viewpoints. This appears to remain the same during your thread. It's important to never lose this, no matter how good you get at this thing called investing...we are forever learning...

So first question...have you changed/tweaked anything in your rules due to your now +1 year of direct experience?

This leads to what IMO is the most important aspect of investing....evaluation. Whether you were successful or not it is important to objectively evaluate our performance against some kind of standard. Would you please rate your performance against the following standards?

Did you have fun?

1) What is this thing called fun?

5) Wooh! All funned out.

Did you learn and improve?

1) What? er?

5) Nosce te ipsum to the max!

Did you set correct goals?

1) I didn't get my gold toilet seat!!!

5) I was within a hairs breath of where I thought I would be.

Let's talk about CAB, our last posts on the subject are back on posts 340-350 Disclaimer: I currently don't hold CAB

Ahh you can tell from the above I took my profit out of the trade...here were my words back then

Background

I entered on the 4th of July at $4.1457 for 18,000 units, in accordance with a positional sizing model I use. At that time my target from a technical perspective was $4.50, the point of significant horizontal resistance. This is not a take profit level, merely where I anticipated that the stock would find some price resistance.

In the immediate term however I still have a short-term unsustainable compound curve...meaning that I anticipate a retracement or consolidation in the share price...but only in the short-term. I am therefore faced with a choice. I can take my profit now and then attempt to purchase once again at the bottom of the retracement level, or I can anticipate a retracement will occur, set an appropriate stop level and look to see whether the longer-term emergent pattern is revealed.

Ok so I exited the stock @ $5.7225 for a $28,382.40 profit or ~38% net profit (we had almost the same level of performance).

I asked you about the level of CAB before you'd consider it again...and of course we've also had some changes to the fundamental influences...

So as a little bit of a thought experiment...what are your thoughts in relation to them now?

BTW here's a chart...even though I now you don't like them.

Cheers

Sir O