- Joined

- 22 August 2008

- Posts

- 914

- Reactions

- 20

Hi KTP,

Thought I would pop in and say G'day and have a chat about how things are going. I see from your last post that you are doing all right...good to know.

Ok so I also thought I would take this opportunity to talk about CAB. *Disclaimer* I currently hold CAB* I wrote the below on the 31st of July last year for you...

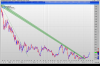

The bit I would like to focus on is in the last paragraph that I highlighted in bold. You're now up...about $0.90 or 23.82% on your original purchase, but take a look at the chart below...

Ok so I was two weeks out and it started it's capital growth in Mid July...

So as I usually do...it's question time!

I didn't hold for almost a year..a year in which I was able to find other stocks, for Eg I'm on record as holding JBH during that period of time and getting a ~20% price movement before exit in November. Does this help explain why previously I have said that I attempt to time my entries and exits?

At various points in the first quarter you were positive and negative on the stock. How did you feel about this?

You've also said....

So what's the thinking with CAB at the present time? What do you think will happen to the share price in...the immediate term and the longer term?

What caused the price movement?

Here's a longer term look at the price chart...

Have you decided upon a profit target?

That's all for now, I'll come visit again and check out your responses.

Cheers

Sir O

Thought I would pop in and say G'day and have a chat about how things are going. I see from your last post that you are doing all right...good to know.

Ok so I also thought I would take this opportunity to talk about CAB. *Disclaimer* I currently hold CAB* I wrote the below on the 31st of July last year for you...

I'm not wanting to sound critical here, just trying to demonstrate the differences in how people (and therefore the market) think, using myself in the role as a commentator/analyser on the stocks you've selected as "good" companies. So far you've indicated that you have purchased CAB, SDL and LYL. Ok let's take a look at one of them and I'll choose CAB because it was the first you purchased and you mention it below. (I haven't looked at CAB for a while - so this should be interesting). This is the normal process I go through, (and for this example will be somewhat superficial - I just want to tell you what I'm thinking)... NOTE - I DO NOT HOLD CAB. THIS IS NOT ADVICE...DON"T MAKE ME GET THE DISCLAIMERS OUT. I MEAN IT. DYOR.

CAB - Mcap 523M 120 Million shares on issue Average of broker consensus - Sell recommendation price target $4.49 current price $4.43 (Ok so with that MCAP the stock is well outside the top end of the market. As such in terms of how I would categorize the stock it does not meet my criteria for a "Blue Chip" portfolio. (It does meet a couple of the requirements, but it fails for me to class it as blue chip {and therefore be prepared to hold the stock on a longer-term - across market cycles - basis}). It would therefore fit into one of the other categories I use to determine the appropriate time to invest in the this type of stock. Income, Growth, Cyclical or Defensive. These are dominant categories - frequently stocks possess attributes across categories. Looking at the stock it would appear to have income characteristics (nominally due to the high payout ratio), but have significant growth/cyclical characteristics. It's greatest optimal entry for a capital growth objective (as opposed to an income objective) would therefore tend to occur in a late cycle of the broader market cycle. Prior to late cycle it would be suitable as a trading position. Are you intending to hold this for yield or growth?

Earnings 0.48

Market 0.98

Sector 0.68

Actual NPAT fall in 2012 Forecast NPAT fall in 2013 2014 Ouch! errr that's not attractive, that's catching a falling sword. There would need to be a significant announcement on the 22nd of August when it releases it's Prelim Report. Taking a look at those numbers immediately turns me off the stock and makes me wonder if there is a short position to be had at the end of August depending upon the prelim report.... we'll see.

Top five shareholders hold 48.94% of issued capital Hey that's not half bad...hope none of them pull the pin. In fact I think I might see if any of them have been adjusting their holdings (Looking for either an overhang or predatory behaviour)... Hmm So UBS Australia has been been selling down but UBS London have been buying up as has Aberdeen (based in Singapore) in the last few months....in fact hold about 14% of issued capital... I see them doing this for yield in comparison to yields in their home countries - confirmation of the income characteristics I spoke above.

Hmmm ok so a purchase now would seem to be a contrary to popular opinion but overall Institutions seem keen under an income basis to acquire. On one hand you have an obvious headwind in the short term time-frame you are working against. On the other hand the Insto's tend to be sticky holders and 14% holding isn't insignificant). But I do want to ask.....how does the above match up with...

My bolds.

It would seem that the market, superficially at least, does not agree with your assessment. But, this is the art of stock selection, finding good companies that are sold well below their intrinsic value, and then allowing the market time to recognize the intrinsic value. I would have said that (without doing any TA) that you were early in your purchase if your objective is capital growth, as an upwards trend of sentiment does not yet exist, but that early signs are there for the possibility, but it may be six to 12 months away. I would start looking at the announcements from here on looking for fundamental stability and news flow. It is at this point I would normally go do TA to see if the tech and fund align or if I just got it wrong - but you aren't interested in that. (One quick look tells me that the stock has been neutrally trending since 2009 and in a negative trend since May 2012.....a period of time where the market went from 4088 to +5000... It's trending against the market). Given that you have said that you are benchmarking against the index....How do you feel about that? (given that expectation is fundamental to financial risk).

Cheers

Sir O

The bit I would like to focus on is in the last paragraph that I highlighted in bold. You're now up...about $0.90 or 23.82% on your original purchase, but take a look at the chart below...

Ok so I was two weeks out and it started it's capital growth in Mid July...

So as I usually do...it's question time!

I didn't hold for almost a year..a year in which I was able to find other stocks, for Eg I'm on record as holding JBH during that period of time and getting a ~20% price movement before exit in November. Does this help explain why previously I have said that I attempt to time my entries and exits?

At various points in the first quarter you were positive and negative on the stock. How did you feel about this?

You've also said....

I also think you misunderstand my approach - it is not buy and hold forever. I will sell things on a regular basis and I have clear price targets + trigger points when I will do so. I also do use position sizing and timed entries.

So what's the thinking with CAB at the present time? What do you think will happen to the share price in...the immediate term and the longer term?

What caused the price movement?

Here's a longer term look at the price chart...

Have you decided upon a profit target?

That's all for now, I'll come visit again and check out your responses.

Cheers

Sir O