Hi Ves,

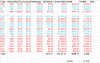

When I bought it at $4.30, it had the following financial characteristics:

PE: 7.5

P/B: 2.5

P/Sales: 0.68

EV/EBIT: 4.8

Certainly not too expensive. But, with an industry that was almost certainly going to go into a period of decline, I do not think this had enough of a margin of safety. Put another way, I was bracing myself to have half the profit for the next few years, which would place it on a PE of 15. And that's too much.

My other purchases in the sector, such as NWH and BYL I am much more comfortable with. I think their pricing allows for a lot more bad news.

I have observed a few things catch people out with the mining services companies.

Firstly there was Roger Montgomery followers with his idiotic static models, the passing of peak earnings had them way overvaluing the stocks and earnings reports are sufficiently slow to see the price decimated before they had information to update their models. Add in a bit of psychology difficulties around taking big losses and lots will probably hold until they just can’t bare it anymore and will eventually lock in a huge losses.

Next, Because the good times had rolled on for 10 years the historical extrapolators got themselves in trouble – they looked back but just didn’t see the depth of a real cycle trough. Not knowing your process real well and looking at the P/B multiple you payed, I suspect this might include you.

I like to try and look forward (even though knowing the future is impossible) and what I say to myself is that operating margins are slim and that contract estimating is difficult. The contract values are large in relation to the equity. Large, difficult and slim margins are not a good combination in the best of times but add in a down cycle where the capacity is larger than the demand in the industry and things get real problematic. If you can’t make your cost of capital you have to shed capacity – Businesses don’t by choice want to shed capacity, so straight away you can see contracts getting bid down to cost of capital margins. So new skinnier margins and you still have the inherent difficulties of large and complicated projects to stuff things up. The lowest bidding companies will sustain their workforces but at increased risk and at best make cost of capital. Other companies won’t find enough work and will have to reduce capacity – if they can’t shed their fixed costs (debt servicing etc ) they are in trouble, even if they can redundancy payments and carrying underutilised equipment etc is going to make the numbers look pretty ordinary.

So I see a scenario where making cost of capital whilst you try and survive the creative destruction of an over capacity part of the cycle as the best outcome – If you can only make cost of capital, then you are only worth the replacement cost of your assets. That’s the upper limit and many will be worth less.

What competitive advantage does LYL have that means it can make more then it’s cost of capital through an entire cycle – If it doesn’t have a true competitive advantage it will still be able to make higher rates during the under capacity part of the cycle but it will make less during the overcapacity part. It will average out above cost of capital only if it has a competitive advantage over its competition.

If you work through how operational leverage works on a business – the least robust companies actually get the biggest boost from a beneficial industry tail breeze and then go bust when faced with a head wind. So just looking at the best performers in the upswing is dangerous (FGE)

So far I’ve had a crack at UGL (not entirely engineering services thesis) and bailed – so still on the sidelines for me with this sector. The Infrastructure focus of the government might aid some companies.

Sorry just rambling – I’ll stop now.