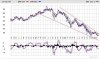

if you look at the fall from grace of all the banks, resource stocks and the rest ........how do you determine what is good value ???

Agreed - but the fall from grace is not forever. There WILL be a bounce. The stocks WILL recover. Australia's most-successful investment bank at that rate means to me that it is good value. I believe that this is a once-in-a-lifetime opportunity to buy, and MQG is one of the best.

Remember, all things that fall have to stop and rebound sooner or later.